Consider paying cash (at least sometimes)

Hey there—

I am not going to tell you to skip having insurance. Although it often sucks, it’s still a backstop against some of the worst-case scenarios.

But sometimes, you may want to skip using your insurance and try paying cash. You could pay less for care that way. A lot less.

That’s because of the one-two punch that often makes health insurance so lousy.

-

Most of us have high deductibles — the amount we have to pay before insurance kicks in for most things1 — often in the thousands of dollars.2

-

Insurance companies frequently do a lousy job of negotiating prices with health care providers.

So even if a provider would accept a lot less if insurance weren’t involved, we can still end up on the hook for wild amounts.

This is exactly what happened to Sandeep, who we talked with on a recent episode of An Arm and a Leg. He got socked with a $1,339 “facility fee” after his daughter’s very-uneventful ER visit.

As Sandeep learned later, he could have paid about $1,000 less for that visit if he had skipped using his insurance.

Yep. That hospital would have taken about $348 from an uninsured patient, no questions asked.

But Sandeep’s insurer had agreed to pay that hospital $1,339 for the “service” his daughter received. Sandeep hadn’t met his deductible, so he was responsible for the whole bill.

Next time, Sandeep plans to tell the folks at the front desk: “Don’t run this through my insurance. I want to pay cash.”

And he’s not wrong to try that. Folks are starting to publish research about these price disparities, and I’ve come across plenty of examples in my reporting.

But like every other money-saving tip, there are a lot of things to consider before you do anything. Let’s get into it.

A warning: You can’t always pay less this way

Sigh. Whether you would save money depends on what price your specific insurance has negotiated with this specific provider, for this specific service.

Researchers found at least some insurers had gotten a lower price than the cash rate in most cases they studied. That doesn’t guarantee savings every time.

If you want to study something nerdy, the New York Times laid out some examples.

At one hospital they analyzed, the cash price is almost the very lowest price the hospital takes for a colonoscopy.

But at two other hospitals, the cash price was pretty much in the middle — lower than half the insurance-company prices, higher than the other half.

Find out if you can save by comparing prices first (if possible)

If you’re not in an emergency situation — like, you need a test done, or an elective procedure — you can do some homework to understand which option costs less.

Sometimes it’s easy to check: The hospital or testing center may have an online tool, like this hospital system in New Jersey, which allows you to see the cash price — also called the “self-pay” price — and what your insurance would pay.

Also, sometimes you can look up cash prices at local places with this tool from a company called Solv. After that, call your insurance or the provider to find out the price with your insurance.

Or you can just call the doctor’s office (or testing center or hospital) and just ask: “I need this service. What’s the cash price, and how much would it be if I used my insurance?” You can double-check the second part with your insurance.

The process is kind of a hassle, especially if you want to scope out multiple providers.

And of course, there’s homework before that homework

To look up your exact procedure or test, you need to know the CPT code,3 which we’ve talked about before.

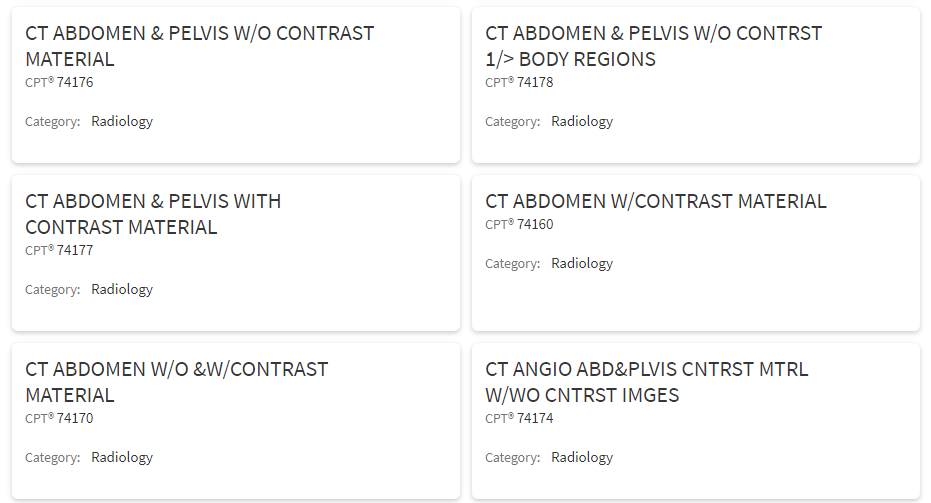

For instance, I tried looking up the price for a CT scan of the abdomen at that hospital system in New Jersey, and found several results.

So, whoever is referring you for a test, or procedure, or whatever: Get them to tell you the CPT code for whatever it is, so you don’t get the price for the wrong thing.

Again, this is not always easy — and it’s not fair that we have to be over-achieving extreme couponers to avoid getting shafted for hundreds or thousands of extra dollars.

But … avoiding getting shafted is worth a shot.

Is not using your insurance illegal or something? Nope.

After Sandeep said he’d pay cash in our last episode, listener Michele Sliger wrote in to ask:

If you have insurance, but refuse to disclose it, wouldn’t that be considered some kind of insurance fraud?

Answer: Not on your part, anyway.

Our fellow traveler and former ProPublica reporter Marshall Allen, who is a big proponent of this strategy, points out you absolutely have this right.

Here’s the language, from a two-page Official Federal Government Document you can print (or save to your phone) if you ever need to cite it.

[Y]ou can also ask your health care provider or pharmacy not to tell your health insurance company about care you receive or drugs you take, if you pay for the care or drugs in full and the provider or pharmacy does not need to get paid by your insurance company. [emphasis added]

So, yeah: It’s totally legal to ask your provider to skip your insurance.

But the provider could say no

They could say they have to bill your insurance, and they may have a point.

Jarod Carter is a physical therapist who doesn’t take insurance, and he advises other providers who want to transition to what he calls a cash-based practice. He wrote about the complicated legalities for providers who take insurance but want to accept cash payments.

The contracts that providers sign with insurance companies sometimes say they can’t skip billing through insurance. Carter proposes a workaround for providers but strongly advises that they check with an attorney before trying it.

Why you might not want to do this

Maybe you expect to have a lot of medical expenses this year — like you’ve got a chronic illness, or you’re expecting a baby, or you need a new hip, or…

In that case, you’ll hit your deductible, and your insurance will start helping you pay for stuff. You probably don’t want to spend money on medical stuff that doesn’t count toward that deductible.

Similarly, if you’re running to the ER with something that could be really serious, you probably want insurance back-stopping you.

But if you’re pretty sure you just need stitches or an antibiotic, or another minor thing, consider telling them, “I’m self-pay.”

Have you done this? Share in the comments.

Or write to me using our contact form.

We’re continuing our series on how to deal with medical bills and how to avoid them. See you soon for the next installment, and catch up with previous editions here, here and here.

We’ve got more for you on the podcast and the newsletter soon.

Until then, take care of yourself.

Dan

P.S.: We were featured in the New York Times with a bunch of great other podcasts. If you’re new and found us there, welcome!

A lot of preventative services get paid for before you’ve met your deductible. For a quick refresher on basic health insurance terms, check out this First Aid Kit, or Brian David Gilbert’s hilarious/horrifying video: A Terrible Guide to the Terrible Terminology of U.S. Health Insurance.

More than 60 percent of U.S. workers have deductibles of a thousand dollars or more; one in six has a deductible of $3,000 or more, according to this KFF report. For folks buying insurance on their own, the numbers are higher: $4,490 was the average for individuals who bought insurance in 2021 through ehealthinsurance.com, according to that company’s report.

CPT: Current Procedural Terminology, nerd. Yes, I still owe you a deeper dive into these codes. For now, just know these series of numbers are magic codes that guarantee you’re looking up the right thing.

Get the First Aid Kit Newsletter!

First Aid Kit

Get our latest tips for dealing with the healthcare-industrial complex.