How to mentally and financially prep for the 2026 health insurance marketplace

Health insurance sucks. We’ve always said it. And this year it’s going to be even worse. Whether you get it from work or the Obamacare marketplace, it’s getting more expensive.

But those Obamacare plans are getting hit with what KFF Health News calls a “double whammy”: Double-digit rate hikes from insurers combined with lower subsidies mean everyone will pay more, and some people could see their premiums double.

And because of massive federal cuts to health spending, there will be less help for signing up. It’s bad news — no way around it.

Here are our best tips on how to prepare for this new, scarier enrollment period — and how to get a sense of your costs for next year, so you can start budgeting.

You might be in for a big spike in costs

How big? A lot depends on your income, and where you live.

Where you live affects how much your premium could jump: This analysis estimates a 20 percent average increase, but specific numbers range from 10 percent to 50 — a huge spread — “depending on the carrier, the state, on the market, says Sabrina Corlette, founder and co-director of the Georgetown Center on Health Insurance Reforms.

Then there’s your income: Unless Congress acts to bring back the “enhanced” subsidies — which it could still do, but maybe don’t hold your breath — a KFF analysis predicts people will pay 75 percent more on average.

But subsidies — “enhanced” or regular — are tied to income: At the low end of the income scale, folks now paying zero dollars a month could be looking at paying about $70 a month.

And people with incomes above 400% of the federal poverty level — that’s about $62,600 for a single person or $128,600 for a family of four — would no longer qualify for subsidies at all. (You can check if that’s you here.)

That means paying sticker price for insurance — which can be $10,000 a year per person, or more.

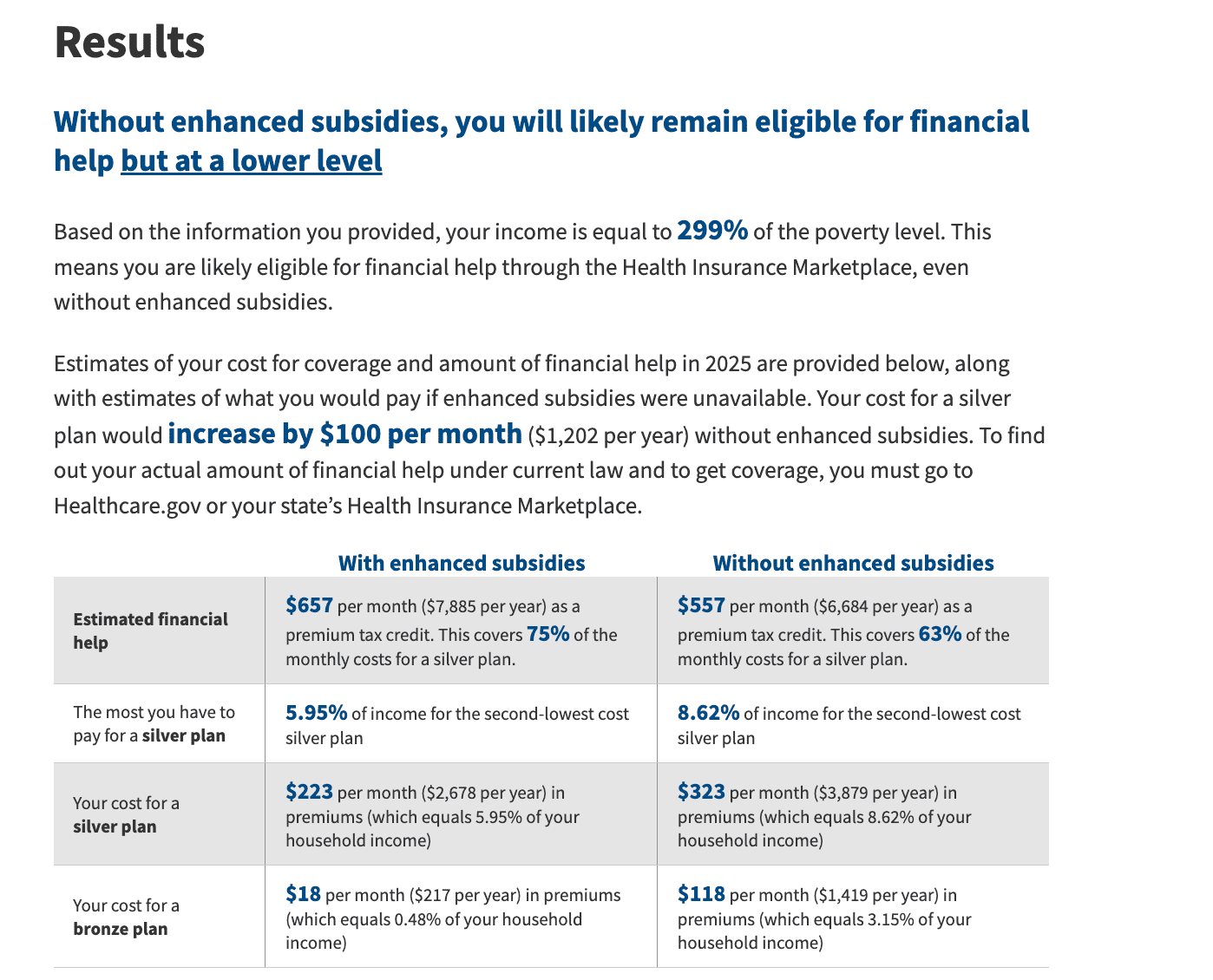

You can estimate how much your monthly costs will go up if subsidies expire with this calculator (scroll to the bottom of the page). Here’s an example:

An example of the results the calculator will give you.

These are the results when I put in my info: an individual living in Brooklyn, New York, with an estimated annual income of $45,000. Without the enhanced subsidies, my costs are estimated to go up about $100/month, from $223/month for a silver plan to $323/month.

One cost-crushing tool isn’t going away: For folks with lower incomes, something called “cost-sharing reductions” still exist. Those can make a big difference by lowering the amount you have to pay out-of-pocket — like for copays and deductibles.

These apply to you if you earn less than 250% of the federal poverty level. To get the cost-sharing reductions, you have to sign up for a Silver plan.

Sign-ups start November 1. Sabrina says folks who are already enrolled should get the gory details — premiums for 2026 — sometime before then. Either way, get an early start, because…

If you need guidance, you may have to wait (and wait…)

Earlier this year, the government slashed the budget for navigators — trained insurance helpers who offer unbiased information about plans in your area.

Now, with fewer navigators, it may take longer to get someone helpful on the phone. (You can, however, contact a licensed broker — but be aware that brokers get commissions from insurance companies.) So, Sabrina says get the ball rolling as soon as possible.

Unfortunately, this isn’t even close to everything

It’s not just navigators — new government regulations and the passage of the “One Big Beautiful Bill Act” mean lots more cuts — like to coverage for lawfully present immigrants, DACA recipients, and providers like Planned Parenthood.1A move that’s currently being contested in the courts.

And in years to come, there will be more paperwork required, too — pay stubs, birth certificates, etc.

But for now, you’ve got the basics. Get ready to pay more and start scoping out your options now.

If you have more questions — or insights — about enrollment in 2026, please send them our way here.

And we have a new Starter Pack with all our previous tips for shopping for insurance on our new website — including some new hustles to watch out for.

That’s all for me. Stay tuned for our next episode: My colleague Emily Pisacreta is going through this planning process right now, and we’ll bring you along for the ride.

— Claire

- 1A move that’s currently being contested in the courts.

Get the First Aid Kit Newsletter!

First Aid Kit

Get our latest tips for dealing with the healthcare-industrial complex.