Please note that this transcript may include errors.

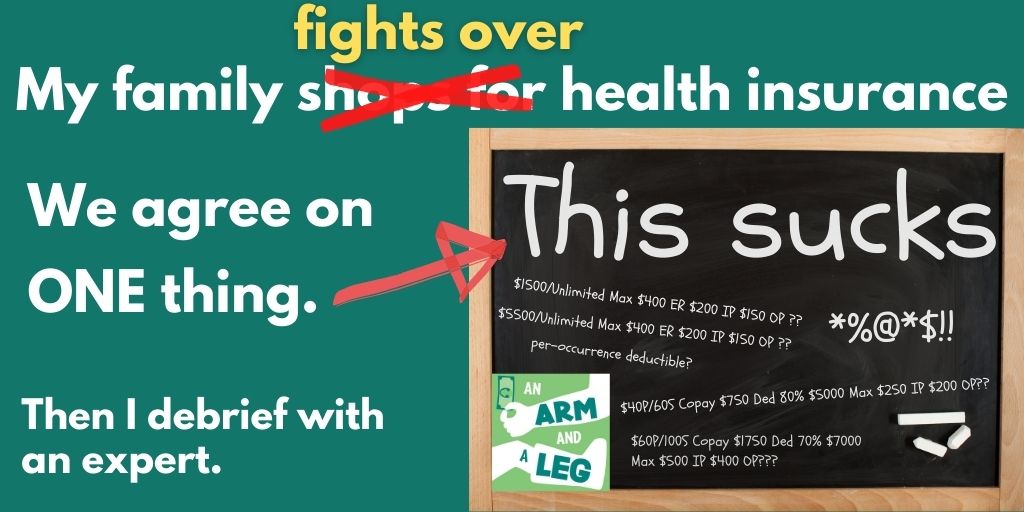

Dan: Hey there— when this show started, one of the big questions was: Geez, what’s my family gonna do for health insurance? You can hear some of how that played out in episodes from our first season.

And the great news was: We were able to get a plan that covered the docs we actually see. Not so great, it was more than our rent. Like hundreds of dollars more. Which— we have a good deal on rent, but still.

And then this fall, we got a spreadsheet from our insurance broker, Kurt: That premium would be going up by about two hundred bucks, come January first. Or there were some lower-cost options we could look at.

We’ve been wrestling with it— and we’re not the only ones. The deadline for buying insurance on the Obamacare exchange is coming up— and a lot of workplaces have open-enrollment right now too.

So…. this show wasn’t due to put out its next episode until next week, but we figured:

An inside look at our deliberations could maybe be useful to a lot of folks right now. Especially because I get to call up an expert and debrief.

This is An Arm and a Leg. A show about the cost of health care. I’m Dan Weissmann. I’m a reporter, and I like a challenge. So my job is to take one of the most enraging, terrifying, depressing issues in American life and bring you something entertaining, empowering, and useful.

And what’s more entertaining than listening to an actual married couple talking about money? I mean, it’s not Real Housewives or Jersey Shore, but …

My wife Devorah took the lead. We made an appointment with our broker and sat down together before the call.

Devo: this plan may be less desirable, but it saves us $8,400 a year premium to this plan. So I just wanted to look at it

Dan: She shows me a spreadsheet from our broker that seems to be written in code. And I’ve been making this show a couple of years, I’ve learned some stuff, but…

Dan: I think the 40 versus 60, what tha? What’s the slash mean?

Devo: I don’t know.

Dan: We talk through what we can.

Dan: let’s ask Kurt about, let’s just ask Kurt about it. Okay. Well I’m ready. I’m ready to call him. Yeah.

Devo: Okay.

Kurt: All right. This is Kurt

Dan: Hey Kurt. It’s Dan and Devorah. Deborah and Dan, how are you? We’re all right. Thank goodness. Yeah.

He answers one of our first questions, like: Why is this going up?

Aren’t insurance companies making HUGE profits this year? Plus, news stories seem to say rates are holding steady.

Kurt’s says news stories tend to focus on policies for individuals. We buy a small group plan through Devorah’s business. Kurt says Blue Cross is hiking those rates an average of 5 percent this year where we live. And we’re all a year older.

Also, there’s averages, and then there’s the specific plan that YOU are looking at.

Kurt: I mean, how they sit and come up with these rates? I don’t know. It is frustrating beyond belief, especially with the crappy year that has been. Now one good thing that blue cross did, is they gave everyone a, like a 15% discount on their November billing statement.

Dan: Yeah I’ve heard about this too: They’re actually trying to limit how much profit they take this year— because there’s a provision in the Affordable Care Act that says if they make TOO much money in a year, they have to give rebates.

OK, and then we get into the nitty gritty. Kurt explains what the slashes mean— I’m NOT gonna get into it here, sounds kind of like this:

Kurt: deductibles and the max out of pockets, cross accumulate .[SFX] per occurrence deductibles. [SFX] to the co-insurance of 80 26. [SFX]

Dan:But there are basically three big differences between the plan we’ve got and the one that’s like 8 thousand a year less.

For one thing, the plan with the lower premium puts some local providers— including our current primary-care docs— into what it calls a second tier: We’d have to pay extra to see them. Or get new docs. For another, it’s got a higher deductible— that’s the amount we have to shell out for medical care before our insurance kicks in at all.

But the biggest deal is what’s called the Out of Pocket Max: That’s a cap on what we might have to spend over the full year. Beyond that, the insurance is supposed to cover a hundred percent of everything.

The plan we’ve got, that cap is under four thousand dollars, for our whole family. The less expensive one, it’s 17 thousand. So that’s like 13 thousand dollars we’d be risking. And I tell Devorah and Kurt, that to me, THIS year, that sounds like a lot of risk.

Dan: I always advise people, um, you know, look at what happens to you and what you could tolerate in terms of risk in a year where you worry about getting hit by a bus.

And honestly like COVID is a giant bus every time you literally cross the street, there’s a lot of buses with drivers who are high out of their minds.

Kurt: Yep

Dan: So, um, so you just got out, so like, keep that in mind when thinking about

Devo: agree with you. But when I think about, you know, say we do take our spend to 1500 a month instead of, you know, almost 22, I also think about, What we can do with that money like, investing it,

and then, we also become more financially stable in other ways.

Dan: Well, right. I mean, would say in a non. COVID year I would be totally, totally down for that.

Devo: Yeah. It’s just so hard to like factor in everything.

Dan: Kurt chimes in to say: You could stick with the more expensive plan for THIS year… and switch to the cheaper one next year.

Kurt: When, hopefully this nightmare that we’re in goes away, and. Now you can take the other savings. And hopefully, we don’t have all the high bus drivers driving around anymore at that point. And then your risk is a lot less.

Devo: I can’t quite make, like, I see the difference, but I just can’t quite like do the math to figure out which of those is better.

Dan: honestly, like all of these plans are actually financially equivalent. Blue cross— with their army of actuaries and armies of accountants. they have exactly calibrated it so that they predict that they’ll make the exact same like margin on every single one of these plans spread out across lots of

Devo: Are you saying the house always wins?

Dan: Yes. The house always wins in the aggregate. Some people. walk in, put a token in the slot machine, hit the jackpot and walk out and the house didn’t win in that case.

Devo: Yeah. This year we’ve paid, you know, $26,000 to, for blue cross to cover almost no medical care.

Dan: Yes. Right. Which is great,

Devo: So they got a lot of free money from us.

Dan: Well, you know what? I am really happy about that because we, um, that means that we didn’t get sick.

Devo: We also didn’t do all the preventative stuff that we would usually do and all the screenings we want to stay out of the hospital.

Dan: This is not a product that we’re buying. This is not, and I think this is a big thing— that all of us struggle with. Mostly we think about like, I’m paying this money. What am I getting for? What thing am I getting? I bought the gym membership, but I didn’t go, I lost that money. That’s true. In the case of health insurance, it’s not true. In the case of health insurance, what you’re paying them for is not for your medical care where you’re paying for them is to insure you against bankruptcy. And that is that, I mean,

Devo: I guess. We gave them so much money this year though.

Dan: I know it’s because we have, I mean, in my view, such a screwed up system,

Devo: okay. Okay. Okay. We should, we should let Kurt, and Kurt, thank you so much

Dan: Thank you

Devo: so much.

Dan: All right. Thank you. Thank you. Likewise. Be safe. Take care. Bye bye.

Okay. Good talk. Good — highfive. All right. You’re the best. Thank you. Thank you. how much of that was. real, like, “I don’t want to pay this much.”

And how much of it was like, “I’m giving you materials so you can explain stuff.”

Devo: That was all fucking real. Are you kidding?

than we pay in rent and now it’s going to be like two, like a third more than we pay in rent.

Dan: Yeah. It’s pretty wild. We do have really good rent though,

Devo: I’m actually leaning towards the cheaper plan, but let’s, we’ll talk.

Dan: I love you

Devo: Walking away now.

Dan: Bye.

(We’re totally gonna fight if he wants that plan. Okay…)

OK that was the conversation at home. And then I wanted an expert opinion.

So I got one. And things got interesting…

That’s in just a minute.

This episode of an arm and a leg is a coproduction with Kaiser health news. That is a nonprofit news service covering healthcare in America. Kaiser health news is not affiliated with the big healthcare outfit. Kaiser Permanente will have a little more information about Kaiser health news. At the end of this episode.

Late last summer I’d talked with Karen Pollitz — she an expert on health insurance at the Kaiser Family Foundation— and yep, that’s the outfit that our pals at Kaiser Health News are part of. The rest of the foundation is basically a think-tank about health care. Their whole enterprise —outside running a newsroom— is to have a staff of non-partisan experts that people like reporters can call. Reporters like me, and experts like Karen.

I emailed her and she was like, “Hey send me that spreadsheet. And maybe see what you could get on healthcare dot gov”

So I did. And basically the first thing she said was: Given everything she sees, it’s not like the deal we were looking at was… that bad

Karen Pollitz: trust me. I know that’s a lot of money, but for a family policyit’s, I mean, Yeah, it’s a lot of money, but for a family policy, I don’t think it’s in the stratosphereof what you could

Dan: right? I mean, it’s not, like, Oh my gosh, we’re getting reimbursed anybody. Else’s just like, this is what they take you for.

Karen Pollitz: no, right. This is more than my mortgage check. No, that I die. Get that. . Yeah. Health insurance is expensive.

Dan: And then God forbid you actually need medical care.

Karen Pollitz: I mean, yeah, when we don’t make claims, we don’t make claims, but when we do it’s expensive. you know, as a cancer survivor, I have learned that one the hard way. Yeah. I mean, those are a hundred-thou— yeah. So the average family policy in the United States in employer sponsored is 1700 a month.

Dan: and the average, like deductible keeps going way up, so you’re always kind of trading off. yeah. I mean, I, so you’re sighing

Karen Pollitz: No, I hate that. Trade-off I do. Because then it’s a tax on sick people, right. So everybody has to pay the premium and then, Oh, if you get sick, then you’re going to really pay. That’s my cancer survivor outlook, but I don’t like that

Dan: it’s what you’re buying insurance for, right?

Karen Pollitz: while you’re not buying it in case you stay healthy. Right.

Dan: right. Yeah. You’re buying insurance for, in case something really bad happens to you. You want to be protected from getting wiped out financially

Karen Pollitz: and you want to be able to get care right? A lot of folks won’t talk to you if you don’t have a card in your pocket.

Dan: right. Holy Crap.

Karen Pollitz: So yeah. So there’s that?

Dan: And why do deductibles keep going up? Super-shorthand: The total amount we spend on health care as a country keeps going up. Health insurance companies are either gonna raise premiums to cover those increases, or they’re gonna cover less— by raising deductibles, or paying a lower share of what they do cover, or … whatever. Because they’re not in business to lose money. Ugh, it’s like you could do a whole podcast series on this stuff.

Anyway, I tell Karen about how I’m seeing our family’s choices. Like, yeah we could pay lower premiums, but this is a year when you really have to look at the worst-case scenario. All those intoxicated bus drivers.

Karen Pollitz: no, it’s, it’s, it’s not a good year to skimp on insurance. I think that’s absolutely fair to say. so I mean, it’s nice that you have these choices, right?

Dan: And I’m like, right. And we look together at the plans from the healthcare dot gov site. Only one of them covered the main docs we usually see— came in Bronze, Silver and Gold versions. And they were expensie. I mean, holy crap, the BRONZE one was a lot of money— more than 15 thousand bucks a year. And it had a family DEDUCTIBLE of 17 grand. Like, before it paid for almost ANYTHING, you would have to shell out up to 17 thousand dollars.

And even the gold one— which wasn’t THAT much cheaper than the super-expensive plan I want to buy— had that out of pocket maxiumum of 17 thousand bucks. That’s the same as the cheap plan my wife wants.

And this plan had all these holes in it. Like if you needed some super-expensive “specialty drug” — like cancer drugs these days— you were supposed to pay 40 percent. Which could be thousands of dollars. And that’s if it was on the approved list. Otherwise you’re on your own.

I told Karen, it made me kind of emotional

Dan: to see how big a hole you could fall into while paying, you know, $1,800 plus a month for insurance. I mean, this is if you can afford this plan, if you believe you can stretch to afford this plan, you’re still not. Safe.

Karen Pollitz: No, it’s, it’s true, Dan. And, . Medical debt among people with health insurance has been with us for a long time. I remember when Elizabeth Warren was still a professor at Harvard and she did her first study saying medical bills are the chief cause of personal bankruptcy.

And most of the people who declare bankruptcy had insurance.

Dan: This is the whole thing I’m fighting with my wife about: I want our insurance to be solid enough that we don’t become one of those folks. And as Karen says, this people-with-insurance-going-bankrupt phenomenon is very much still a thing.

Karen Pollitz: Our survey with the LA times last year of people with employer sponsored coverage, found that half.

Half of all people with employer sponsored coverage skipped or put off care because they couldn’t afford it. They were afraid of the out-of-pocket medical bills.

And that’s the good stuff, right? The employer sponsor coverage. It’s not that good anymore.

Dan: She says the trade-offs we talked about earlier— the kind of heads-I-win, tails-you-lose stuff, where insurance companies cover less: Another part of that is limiting which providers are actually covered under a given plan at all.

Karen Pollitz: So, Ooh, if you accidentally step over here, we don’t have to pay that claim at all. And that makes the premium lower, but it just means your exposure to out-of-pocket medical bills gets higher

The terror of medical bills and maybe losing your house or your retirement funds or your kid’s college fund, you just, you don’t need that on top of the terror of being really sick.

Dan: And that terror, Karen knows all about it. She’s had cancer. Four times.

Karen Pollitz: Yeah, with cancer, you go where this, you know, you have to get this MRI. You have to get this radiation therapy. You have to get, you just go where they send you. I mean, you have to, but I, I remember after my first surgery, um, I came home, my daughter was in diapers, um, and everything had been kind of pre-authorized and everything else. I get home and this bill comes from the hospital and it says it had been declined by insurance.

And I sat down on the floor and I started to sob. I thought. I’m going to die. And my baby’s not going to have a house to live in when I’m gone. And, and it turned out it was just a screw up and somebody had coded something wrong, but, and I eventually pulled myself together and fixed it. But right at that moment, I couldn’t be an advocate for anybody.

I was. I was sick. I had stitches and tubes in me. I was a mess. And any rate, it’s just all by way of saying, I think people really do want insurance to stand in for them and say, I’m going to focus on getting better and you’re going to take care of the bills. And that’s it.

Don’t make me shop for chemo. My hair is falling out and I can’t do it. I just can’t do it.

Dan: Yeah, man. So at my house, we are shopping for insurance. We’re still kind of fighting it out.

And I am all kinds of grateful that we even have the options we do. I feel kind of shy about even talking about them. That we can scrape together the money for the premium. That we have the option at all: If we were buying insurance through the ACA exchange, it would be worse. If we were working for someone else, we’d have to take whatever they were offering. Karen says half of everybody who gets insurance through their job skipped some treatment last year. Holy crap, I did not know that. And that was last year, when more people had jobs.

So look, here’s where I get to the good news. The part that’s useful beyond just the — It’s Not Just You part.

First, if you’re hearing this before December 15, and you don’t have health insurance lined up for next year: You can probably get some. According to the Kaiser Family Foundation, a quarter of people who don’t have insurance qualify for a no-premium plan. In most states, if you don’t have a job or much income, Medicaid is an option. And subsidies mean that Silver plans are as low as 50 dollars a month for lots of people.

There’s a TON to not love about these options— all the stuff that Karen Pollitz and I talked about— but being uninsured is so, so much worse.

And if you’d like a little more info about how health insurance works, and why it actually sucks, and why it is SO HARD to pick a the best plan— or if you’d just like to hear me and Devorah going at it [She is so great], I really recommend some episodes from our first season.

We’ll have links to all of that from wherever you’re listening right now, including information about getting insurance.

Thank you to everybody who has been signing up to support the show

at arm and a leg show dot com, slash support. This month, thanks to NewsMatch, your donation counts for double. And if you sign up to make a new monthly donation of any amount, NewsMatch chips in for a full year’s worth, up front.

That’s at arm and a leg show dot com slash support. IF you feel like it, and if you can.

We’ll be back next week. Till then, take care of yourself…

This episode of an arm and a leg was produced by me, Dan Weisman and edited by Marian Wang. Daisy Rosario is our consulting managing producer. Adam Raymonda is our audio wizard. Our music is from Dave Weiner and blue dot sessions.

This season of an arm and a leg is a co production with Kaiser health news. That’s a nonprofit news service about healthcare in America, an editorially independent program of the Kaiser family foundation. Kaiser health news is not affiliated with Kaiser Permanente. The big healthcare outfit. They share an ancestor. This guy, Henry J Kaiser. He had his hands in a lot of different stuff.

He poured concrete for the Hoover Dam in the 1930s, built ships the 1940s, and made CARS in the 1950s. Including the Jeep— and a car called the Henry J.

Seriously, he died more than 50 years ago. He left half his money to the foundation that later created Kaiser health news. You can learn more about him and Kaiser health news at arm and a leg show dot com slash Kaiser.

Diane Webber is national editor for broadcast and Tonya English is senior editor for broadcast innovation at Kaiser health news. They are editorial liaisons to this show.

Thanks to Public Narrative — a Chicago-based group that helps journalists and non-profits tell better stories— for serving as our fiscal sponsor, allowing us to accept tax-exempt donations. You can learn more about Public Narrative at www dot public narrative dot org.

Finally, thank you to folks who have pitched in — since just last week— at arm and a leg show dot com, slash, support. Thanks this time to:

[names redacted]

THANK YOU!