Episodes

The Prescription Drug Playbook, Part Two

Experts share their insider tips. Episode two in a two-part series.

The Prescription Drug Playbook, Part One

How to get prescription drugs at a more-affordable price. First in a two-part series.

Could this mathematician’s formula fix US hospitals?

A mathematician on a mission: save U.S. hospitals from financial ruin, and improve the lives of doctors, nurses, and patients. It's already working.

A longtime expert puts 2025-so-far in perspective

Two stories that suggest the big picture in health care, with KFF Health News

Why ‘The Pitt’ is our fave new drama

A real-life ER doc on ‘The Pitt’ and why ERs are so crowded — and bills are so high.

Winning a two-year fight over a bogus bill

How one listener stayed encouraged during a two-year fight over a bogus medical bill.

A medical-debt watchdog gets sidelined by the new administration

The Consumer Financial Protection Bureau is offline (for now) – what that means for people with medical debt.

How do you deal with wild drug prices?

Tons of people spend so much time and energy trying to get their meds at a reasonable price. We want to hear how it’s going for you.

The ‘Shkreli Awards’ — for dysfunction and profiteering in health care

The Lown Institute’s contest for this year’s most outrageous stories of health care greed.

A listener fighting the good fight

To close out the year, we spoke with a very cool listener – a medical resident fighting for change with the AMA and at the hospital where he works.

Revisiting ‘Christmas In July’

From the archives: a family tragedy, a 40-year tradition, and a $1 million in medical debt erased.

New lessons from the fight for charity care

Checking back in on the fight for hospital charity care, with lessons from Dollar For and you.

Fight health insurance — with help from AI

A new tool helps fight back against health insurance denials, by writing appeal letters with AI.

Can racism make you sick?

Violence, silences, and public health, with journalist Cara Anthony.

“Baby steps” in the fight against facility fees

Some states are trying to limit tacked-on facility fees.

Don’t get “bullied” into paying what you don’t owe

How one woman stared down a six-figure medical bill and won.

We want to see your hospital bills

Gotten a hospital bill in the past year? We want to see your bills

The woman who beat an $8,000 hospital fee

Facility fees are becoming more common – and one woman was determined not to pay.

Meet the Middleman’s Middleman

Way behind the scenes, a hidden player makes billions — cutting what your health insurance covers. Meet MultiPlan.

Staying on Medicaid seems tougher than it should be

States were blocked from their annual Medicaid re-enrollment during the COVID health emergency. Now they’re catching up and taking away coverage for millions.

We’re digging into “facility fees.” We need your help.

Why we’re collecting your stories about these sneaky fees.

The Hack

A cyberattack against a health care giant gets us thinking about antitrust: The idea that companies this big can be dangerous, and what we can maybe do about it.

Son of Medicare: Attack of the Machines

How UnitedHealth used an algorithm to cut off care for seniors in Medicare Advantage plans.

The Medicare Episode

When you turn 65 you have a high stakes decision to make: original Medicare or Medicare Advantage. And what you choose has major implications down the line. We break it down.

Wait, is insulin cheaper now?

We break down some news about insulin — the so-called “poster child” for the high cost of prescription drugs — and what activists still want to see happen.

Self defense 101: Keeping your cool while you fight

Maybe our most useful episode ever: A self defense expert gives us tips for keeping it together when dealing with the health care industrial complex.

One last tip before 2024

What some hospitals may not tell you about charity care.

When hospitals sue patients, part 2

Part two of our story with Scripps News and the Baltimore Banner: In some states, hospital lawsuits have dropped dramatically.

When hospitals sue patients, part 1

We investigate why hospitals sue patients over unpaid medical bills, with Scripps News and the Baltimore Banner.

To qualify for health insurance, this couple made a movie

To qualify for health insurance, Ellen Haun and Dru Johnston made a movie about health insurance. It’s called “Ellen Needs Insurance.”

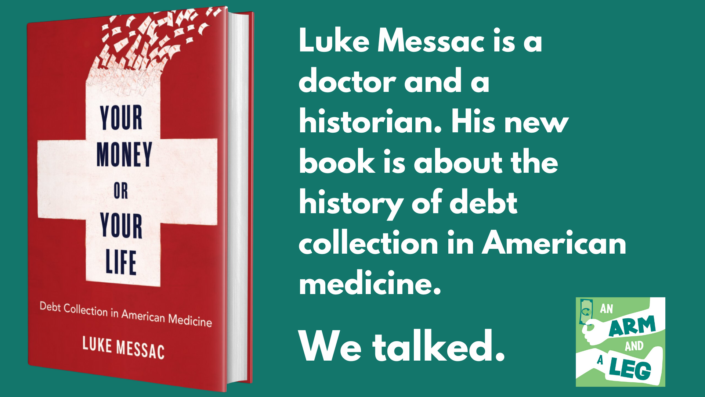

“Your Money or Your Life”: Dr. Luke Messac’s book on the history of medical debt

Luke Messac’s new book, “Your Money or Your Life,” traces the history of debt collection in American medicine. He’s a doctor and a Ph.D. historian.

Paging Dr. Glaucomflecken (via the Nocturnists)

As Dr. Glaucomflecken, Will Flanary’s punchy and funny videos on our awful health care system have made him a fan favorite. Our pals at The Nocturnists got a chat.

John Green vs. Johnson & Johnson (part 2)

Part two of our globe-spanning story about drugs, patents, and YouTube megastar John Green.

John Green vs. Johnson & Johnson (part 1)

Writer John Green rallied his fans around a fight over the cost of a tuberculosis drug. And: the story shows why so many drugs cost so f-ing much.

How to Get a Surprise Bill on Your Way to the Hospital

Ambulance rides are one of the most common sources of surprise medical bills. So why did Congress leave them out of the No Surprises Act?

Wait, what’s a PBM (and how do they work)?

If you've been told your insurance won't cover your meds, you've met a PBM: a pharmacy benefits manager. And experts say they play a big role in jacking up drug prices overall. But how, exactly? We took a deep dive.

Credit Card, Please

A listener's doctor wanted her credit card info up front , before her appointment. She wondered: Do I need to give it to them? We did too.

A ‘payday loan’ from a health care behemoth

What does it mean when a single company runs the most U.S. health insurance plans, owns a network employing more doctors than anyone else, and starts to get into the business of loaning money to doctors? Get to know UnitedHealth Group: the Behemoth.

Mental health ‘ghost networks’ — and a ghost-buster

Trying to find a therapist can be a horror story. It's also a ghost story , as in "ghost networks": lists of therapists your insurance says are in-network, but *poof* they're not.

Now, meet a volunteer Ghost-buster.

Now, meet a volunteer Ghost-buster.

A $229,000 medical bill goes to court

Before surgery, a hospital told Lisa French she'd owe $1,337. After insurance paid them , more than they'd expected , the hospital billed her $229K. And sued her for it. Colorado's Supreme Court decided the case last year. The ruling has big implications.

A doctor’s love letter to ‘the People’s Hospital’

What if we had a decent, publicly-funded health system , available to everybody, with or without insurance? We've got one, says Dr. Ricardo Nuila. It's where he works. And he thinks we could have itall over. Yes, really.

Lessons from “wrestling with a giant”

The ER visit was brief and uneventful. The bill was $1,339. Our listener decided to push back. He didn't win, but he learned a lot , and so did we.

The bill looked like BS. So she took it to small claims court.

A listener wrote: "I sued a hospital in small claims court." She lost, but felt like she'd won , and learned a ton. Now she wants to encourage more people to try it.

Can They Freaking Do That?!? (2023 Edition)

Can a random medical provider send you an outrageously random bill? Sure. Can you fight back and win sometimes? Yes. Yes, sometimes you can. It might even be fun.

2022 in Review

The Arm and a Leg team looks back on 2022.

Like Pulling Teeth

Health insurance usually doesn't cover dental work. It's as if teeth aren't part of our bodies. But when a car hit Susan and knocked out half her teeth, that WAS supposed to be covered. So why has her insurer batted her away?

Is this the best video on health insurance ever?

Listeners told us: 'you gotta watch this video from Brian David Gilbert about health insurance. You're going to love it.' And we did. Then, we got Brian to fill us in on the whole story behind it.

Insurance in a post-Roe world, and a grassroots network of abortion funds

The Supreme Court's decision to overturn Roe v. Wade put some people's health insurance into flux. But accessing abortion was already hard for lots of people. That's where abortion funds step in.

A listener asks: Could NOT having insurance be a better deal?

Open enrollment for health insurance is here. A listener asks: "Should my son even sign up for insurance? I may have found a better deal."

California plans to make its own insulin and sell it super-cheap. Really.

Lots of seniors have to pay thousands of dollars for drugs,even tens of thousands,or do without life-saving medicine. That's finally going to change.

Congress fixed (a piece of) Medicare. It only took a few decades.

Lots of seniors have to pay thousands of dollars for drugs,even tens of thousands,or do without life-saving medicine. That's finally going to change.

The Medical Bill “Negotiation Lab”

It's often possible to negotiate medical billsbut not always easy. Could we get it down to a science? The folks at the nonprofit Dollar For are running a big experiment. We got to visit the lab.

The Genetic Testing ‘Bait-and-Switch’

Can a health care company make enough people mad to faceactual consequences? In this case, maybe yes.

One ER Doc’s Journey Through the Pandemic , and the Health Care System

Dr. Thomas Fisher's book 'The Emergency' chronicles the COVID pandemic's first year in his Chicago ER. It's a grieving love letter to his patients and his community.

These docs are trying to kick private equity out of their ER

Emergency rooms all over the country are staffed by private equity-backed companies that doctors say put profits before patients. Now a group of docs is suing to get them out of California ERs.

Credit Where It’s Due

Credit reporting bureaus announced in April that they would start taking most medical debt off of people's credit reports. It's a bigger deal than we thought.

“The Golden Age of Older Rectums” for investors

A listener got a pricey quote for her colonoscopy, but the practice she visited seemed like "the only game in town." We scoped it out and learned the surprising reason why: private equity.

Fighting for the right to help

A non-profit called Upsolve wants to train people like pastors, social workers, and librarians to help people know their rights and prepare them to represent themselves in court.

Swimming with sharks

Pharma and insurance insurance companies play incredible, devious, clever games, competing for dollars. They're sharks! And they want to eat us up. Here's a survival guide to those games.

Meet your new rights under the No Surprises Act

A new federal law, the No Surprises Act, protects us from some of the worst out-of-network hospital bills. But there are catches and traps to avoid. We break down what it covers, what to look out for, and who to call if something's not right.

2022 update: How to avoid a big bill for your COVID test (feat. Sarah Kliff)

COVID testing,the kind they send to a lab, is supposed to be free in the U.S. But it's never been quite that simple.

Our year in review

As An Arm and a Leg wraps up a big year, some of the team behind the show takes a moment to reflect.

Why rapid COVID tests are so freaking expensive

Who's making a buck: rapid test edition. Rapid, at-home COVID tests are pretty much essential if you want to see friends and family this holiday season, and stay safe. But they're expensive and can be hard to find. What the heck happened?

Fighting with health insurance is easyfor Jacqueline Fox

Health insurance is like some medieval horror, says law professor Jacqueline Fox. But, funny thing: She also says insurance fights are easy. For her. She's been helping people win them for 30 years.

How to avoid the crappiest health insurance.

It's open enrollment: Time to pick health insurance. How one journalist almost got roped into a scam. Plus, some top health insurance brains guide us through open enrollment this year.

The Insurance Warrior takes on a $61B Company

When Mattew Lientz needed surgery to save his life, his insurance wouldn't cover it. Enter: Laurie Todd, the Insurance Warrior. Her first task: Figuring out who Matthew was really fighting, and how big the battle really was.

The Insurance Warrior, part 1

Laurie Todd calls herself the "Insurance Warrior." She helps people get their insurance companies to pay for treatment, and has written detailed books sharing her knowledge. But that wealth of knowledge was hard won.

We spend 12 million hours a week talking to our health insurance

Sowe should probably learn how they actually make money,understand their incentives. One clue: Often, providing insurance isn't their real job.

Wait, that was legal until now?!

Hospitals in Maryland were suing patients over bills that should've been forgiven. It wasn't illegal , until now. How a coalition changed that this year. Plus, our friends at Dollar For build their bill-crushing army, one Zoom training at a time.

Using charity care to crush medical bills: Six top tips.

Jared Walker, whose 60-second TikTok video on charity care went super-viral, is now training volunteers to help people apply for aid. We sat in. And took notes.

“We just kept right on pushing” … and laws changed

A 24-year-old died because he didn't have insurance. His parents fought back. With help from a tabloid reporter,and seasoned advocates,laws changed.

The wild backstory of a tiny but crucial Obamacare provision (ft. David Axelrod)

How one Republican senator made sure the ACA required non-profit hospitals to act more like charities,and less like loan sharks,before voting against the whole bill. Plus, how the battle over the ACA "broke America", no big.

A legendary lawyer sued hospitals for price-gouging their patients. And got his butt handed to him.

Dick Scruggs is the guy who beat Big Tobacco. But when he took on Big Hospitals... it didn't go so great.

We’re back! Starting Aug 19. And we’ve got some doozies for you.

We've been on a hiatus for a minute, and we are SO excited about what we're coming back with. These are stories we've been collecting for months , some of them for more than a year , and they're big.

Badass volunteers help Jared level up, in the fight to crush medical debt.

Update on Jared Walker, whose viral TikTok described a little-known (and effective) method to "crush" many hospital bills. He's been responding to a mountain of requests for help,and building a system to respond more effectively, thanks to a small army of whip-smart volunteers.

A whole book about fighting effed-up medical bills? Yes, please.

We talk with Marshall Allen,about some of the best tips in his book Never Pay the First Bill; about how you can't win 'em all, and about why it's worth learning all you can and giving it your best shot.

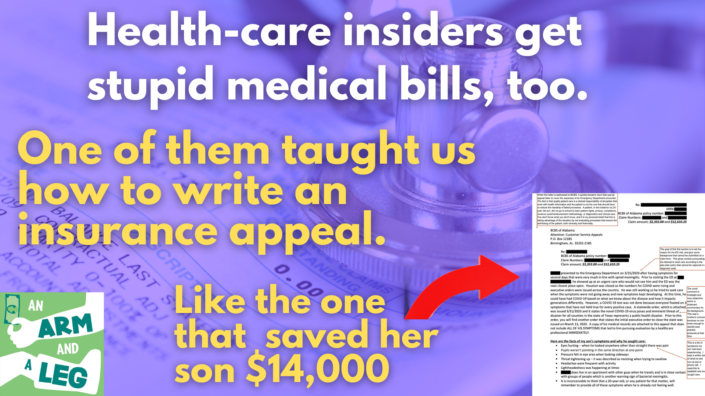

Want to write a killer letter to insurance? Meet Jeannine.

We talk with one health care industry insider who has mastered the art of the insurance appeal. Because even the folks behind the scenes get stuck with big medical bills sometimes.

Mini-episode: One guy skirts a medical-bill trap, and shares the secret.

With COVID vaccinations ramping up, it's time to check in: Who's been trying to make a buck? And who's been doing their best to serve the folks who need help the most? In Philadelphia, the good, the bad, and the ugly have all been on vivid display.

Who’s been trying to make a buck on COVID vaccinations? (And how did racism help them out?)

With COVID vaccinations ramping up, it's time to check in: Who's been trying to make a buck? And who's been doing their best to serve the folks who need help the most? In Philadelphia, the good, the bad, and the ugly have all been on vivid display.

Revisiting insulin, more relevant than ever.

Revisiting and updating a story from 2019: How insulin got to be so horribly expensive,the scientists who discovered it did NOT want price or profits to keep it away from people who need it,and what some people are doing about it, today.

Could billions in medical debt get zapped by the legal strategy from this 60-second video?

Yep. A viral TikTok video offers a legally-sound recipe for "crushing" medical bills, via charity-care laws. Government filings show it could wipe out billions in debts every year,with enough elbow grease. Jared Walker and his group Dollar For say they've done a few million already.

A former “bad guy” lawyer shows us how the dark machinery works. And our rights.

Jeff used to represent medical-bill collectors in court. But he switched sides, and he's here to tell us what he knows.

For instance, we have more rights than we probably know. (Getting them enforced can be tough, but he's got some tips there too.)

And his portait of how the dark machinery works is... kind of hilarious.

For instance, we have more rights than we probably know. (Getting them enforced can be tough, but he's got some tips there too.)

And his portait of how the dark machinery works is... kind of hilarious.

Mini-episode: Two small doses of good news

2021 is off to a rough start, but here are a couple of small things that don't completely suck. First, a new federal rule could help cut through one completely-ridiculous issue. Then, a listener describes how he headed off an insurance nightmare, using what he learned from this show.

A 21st-century Christmas Carol: How one Scrooge became a health-care whistleblower

Former health-care executive Wendell Potter spent part of 2020 publishing high-profile apologies for the work he used to do, the lies he says he told the American people for his old employers,and trying to debunk the myths he once sold. The story of how he became a whistle-blower is a modern-day Christmas Carol.

A peek inside our reporter’s notebook: What we’ve learned in 2020, and where we’re headed, with T.K. Dutes

This episode turns the tables: Host Dan Weissmann gets interviewed about what he's learned this year, and what's ahead for the show, with T.K. Dutes, an ace radio host and podcast-maker ... who was a nurse in a previous life, so she knows a thing or two about the health-care system.

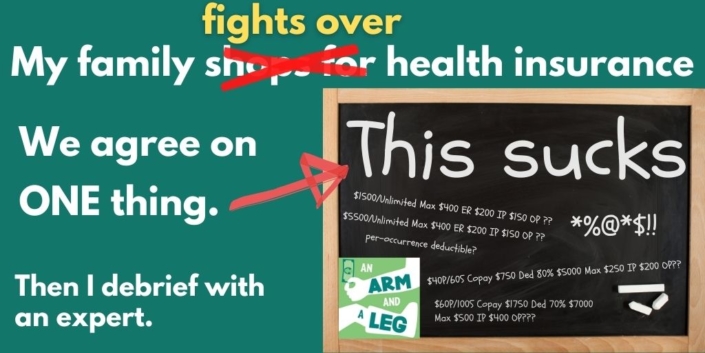

Fight! My family tries to pick health insurance for next year. COVID makes it harder.

Keeping the plan we've got means paying $200 a month more. But... would a "cheaper" plan cost us more in the long run? It depends! And COVID makes it a lot more complicated. This stinks.

You can hear my wife and me try to puzzle the whole thing out, and then I debrief with an expert. Who leaves me reminded how lucky we are to have the options we do. HEALTH INSURANCE SUCKS.

But the alternative is so much worse.

You can hear my wife and me try to puzzle the whole thing out, and then I debrief with an expert. Who leaves me reminded how lucky we are to have the options we do. HEALTH INSURANCE SUCKS.

But the alternative is so much worse.

Andy Slavitt gives us a pandemic check-in, the 40,000-foot view

Andy Slavitt, who ran a big chunk of health care for the Obama administration, has spent 2020 talking with almost everybody who knows anything about the COVID pandemic, and sharing what he learns in real time, first on Twitter, then on his pandemic podcast "In the Bubble." When we wanted an episode taking a look at the big picture,what we've learned so far from the pandemic and what we might expect next,Andy was the person we wanted to talk to.

How to avoid a big bill for your COVID test, with Sarah Kliff of the New York Times

They're supposed to be free. And usually they are. But sometimes... things happen. Here's how to keep them from happening to YOU.

New York Times reporter Sarah Kliff asked readers to send in their COVID-testing bills; she's gotten hundreds,and seen the most common ways things go sideways.

New York Times reporter Sarah Kliff asked readers to send in their COVID-testing bills; she's gotten hundreds,and seen the most common ways things go sideways.

A self-defense expert’s guide to keeping cool in a tough moment

A listener asked: How do I remain cool when calling insurance companies?

We called a self-defense teacher,because self-defense more than hitting and kicking. It's about standing up for yourself in all kinds of difficult situations. Which means using your words.

We called a self-defense teacher,because self-defense more than hitting and kicking. It's about standing up for yourself in all kinds of difficult situations. Which means using your words.

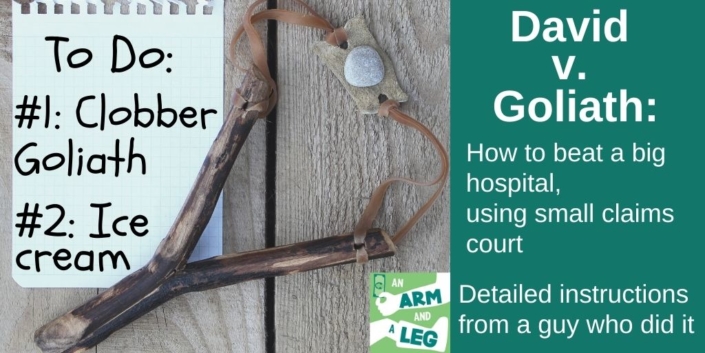

David v Goliath: How to beat a big hospital, using small claims court

In a classic,and hilarious,David vs. Goliath story, Jeffrey Fox takes on a big hospital over an outrageous bill, and wins.

He's a bit of an expert in using small claims court to get satisfaction, and he's got detailed instructions for all of us.

He's a bit of an expert in using small claims court to get satisfaction, and he's got detailed instructions for all of us.

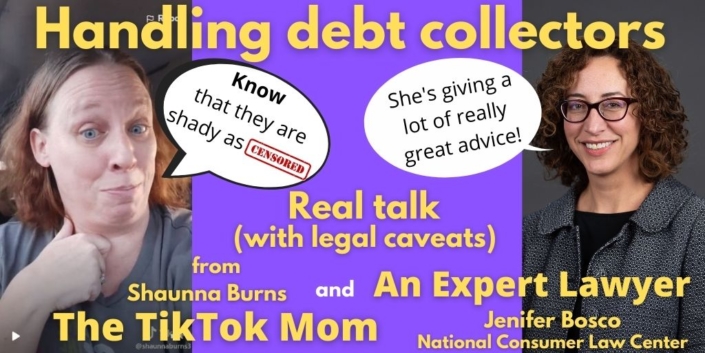

How to handle debt collectors, with the TikTok Mom and an expert lawyer

There's a reason Shaunna Burns went viral with TikTok videos about dealing with debt collectors: She used to be one, so she knows a few things. (Also she's smart and funny.) We fact-checked her advice with a legal expert: Jenifer Bosco, an attorney with the National Consumer Law Center. Who said: Yep, most of Shaunna's advice totally checks out.

Your TikTok mom has some medical-bill tips. And a hell of a story.

Forty-something mom Shaunna Burns went viral on TikTok, thanks in part to a series of videos dishing out real-talk advice on fighting outrageous medical bills. She's become the virtual mom that thousands of Gen-Z followers love,and she's got stories that'll curl your hair. (Yep, medical bills figure into some of them.)

A Blast of Hope and Humanity: Here’s what perseverance looks like

Laura Derrick fought and endured for decades. When medical bills threatened to swamp her family, she made huge sacrifices, worked unbelievably hard... and helped change the course of history.

In a moment when we're all enduring a LOT, this is a great time for Laura's story. It's one of the first stories we ever told on this show, and it has special resonance right now.

Bonus: We catch up with Laura for an update.

In a moment when we're all enduring a LOT, this is a great time for Laura's story. It's one of the first stories we ever told on this show, and it has special resonance right now.

Bonus: We catch up with Laura for an update.

She tangled with health insurance every day for 25 years. And loved it. Here’s what she can teach us.

Barbara Faubion got up every day psyched to go to work,which she says puzzled her friends. "They'd go, 'You love your job?!? You spend your whole day talking to an insurance company. Are you kidding me?'"

She wasn't kidding. Because she loved to win, and she was really, really good at untangling other people's health-insurance problems.

She wasn't kidding. Because she loved to win, and she was really, really good at untangling other people's health-insurance problems.

How to fight like a bulldog (against bogus medical bills and insurance denials)

Steve Benasso is an HR director who, his colleagues will tell you, hates insurance companies, and hates seeing people getting taken advantage of. So he fights off weird medical bills and bogus insurance denials for those colleagues. "I am a bulldog on this stuff," he says. "I do it every month." And on this episode, he tells us how he does it.

Financial self-defense school, now in session: Make your own luck.

If you need medical care, it's like you've entered a casino, playing for your financial life, with the deck stacked against you. Lucky for us, we get insight , and tips the dealer WON'T tell you, from ace reporter Celia Llopis-Jepsen.

The hug shortage, the new abnormal, and the $7,000 COVID test. What we’ve learned in SEASON-19

We wrap up our COVID-19 popup season with three takes on what we've learned so far about what the pandemic is costing us: A doctor and advocate in Brooklyn looks back on the wave of black and brown patients that filled her clinic in March. A nurse-practitioner in Texas looks at how new tech is,and isn't,helping the older patients she cares for.

And: One of the country's top insurance nerds says her first policy ideas to keep people from getting stuck with high bills for COVID tests ... were wrong.

And: One of the country's top insurance nerds says her first policy ideas to keep people from getting stuck with high bills for COVID tests ... were wrong.

How Katelyn survived COVID, without going bankrupt. (Not easy. She has tips.)

In early April, Katelyn was in a financial bind: Home sick with COVID, she hadn't been paid in weeks. And bills were due. "My landlord is kinda beating down my door right now," she said in a voicemail to our hotline.

Weeks later, Katelyn got back in touch: She had made it through, with a heck of a story, and tips that lots of us can use.

Weeks later, Katelyn got back in touch: She had made it through, with a heck of a story, and tips that lots of us can use.

From inside the health insurance company: Angst and advice

A listener, who has worked in health insurance for decades, wrote in after a recent episode. "I have listened to all the episodes in this podcast, and there are times I come away feeling bad working for the insurance company."

We talked. In addition to angst, she shared insights and advice we all can use.

We talked. In addition to angst, she shared insights and advice we all can use.