Want to write a killer letter to insurance? Meet Jeannine.

Our host recently addressed a conference of “industry insiders.” It wasn’t much fun. But he made a new friend. She knows stuff, and she’s sharing with us.

Jeannine Cain started her career working for medical offices, dealing with insurance companies on their behalf, then worked for Blue Cross, and now as a health care data consultant. She really knows how things operate behind the scenes.

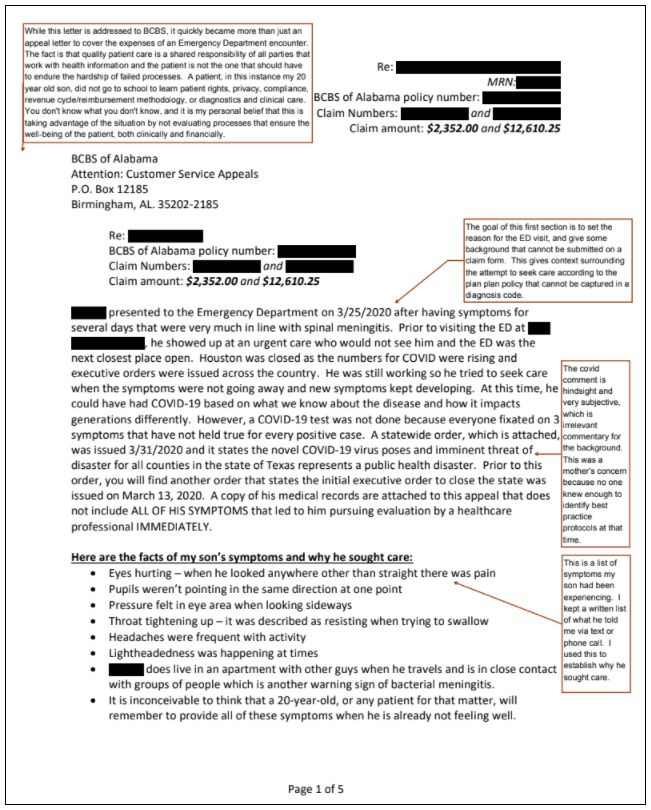

When her son got an unfair, jumbo-size medical bill, she put her knowledge to work, and wrote a killer appeal letter. Now she’s sharing that knowledge, and the letter, with us. Along with annotations about how she structured the letter and why she included the specifics that she did.

It’s pretty spectacular. For all four pages, click on the image below, or right here.

Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG

And of course we’d love for you to support this show.

Dan: Hey there! A few weeks ago, I got invited to be part of a conference by the American Health Information Management Association. They’re like a trade group for health care-IT.

This was a panel on “affordability”— so called. They told me: we can’t pay you— which was good, because I don’t take money from folks in health care— but it’s a chance to address industry insiders.

And I was like, “Do I *want* to talk to ‘industry insiders'”? And I thought, well I probably want to hear what they say to each other.

There were NOT any big revelations, and honestly it wasn’t much fun. But I do think I made a new friend. And she knows stuff. And she’s sharing with us.

This is An Arm and a Leg— a show about the cost of health care. I’m Dan Weissmann. I’m a reporter, and I like a challenge, so my job on this show is to take one of the most enraging, terrifying, depressing parts of American life and give you something entertaining, empowering and useful.

We’re on a break from full episodes right now, but this little adventure is worth sharing.

A week before the conference there’s a planning call. We’ve got a consultant, a lobbyist from a hospital-industry group, and a woman from a health care tech company. And I’m supposed to be the voice of the Consumer.

And while I’m on the call, I’m thinking, “This was a bad idea.” Other panelists are talking about how important it is to help, uh, consumers “understand their financial responsibility.”

And I’m thinking, yeah, How about helping PEOPLE just not get eaten alive?

And somehow in the middle of this talk about how patients just need to get better-informed about our “financial responsibilities” or how tech can help us become smarter “consumers”

… EVERY ONE of these people ends up talking about their own experience that they’re having RIGHT NOW, trying to figure out how much THEY’RE going to end up paying for this medical service or that one, and how hard it is— they’re basically commiserating

And I’m thinking: Look, you’re the industry INSIDERS here. If you’re having a hard time— and of course you are, because this is the American health care system we’re talking about— then how are any of us supposed to be “smart consumers” who understand our “financial responsibilities”?

I ended up kind of dreading the panel, to be honest.

Day came. I told some stories from the show. Here was my bottom line.

we’re not consumers, we’re not shopping for TVs— we’re people trying to survive and we’re, you know, in a kind of money or your life situation,

and the way I’ve come to think of it is we’re in, we’re largely in a crossfire between big institutions, like providers and insurers and pharma companies and anybody else. We look to make a buck in this.

So, no it’s not possible to educate people about their financial responsibility. The financial or financial responsibility gets assigned to you by all of the big players fighting this war in which we are getting caught in the crossfire.

I looked at the video later? I looked kinda mad. I was like, OK. I’m not sure how many hearts and minds I won over, there..

At the end, the moderator asked us about what gives us hope. Other panelists talked about new tech— “data standardization”— and new rules, like extra transparency.

I talked about Dr. Ala Stanford in Philadelphia, who has been knocking herself out to help Black and brown people there get access— first to COVID testing and then to vaccines.

I talked about Jared Walker in Portland, going on TikTok to tell people how to apply for charity care and getting seen by 10 million people.

In other words: Efforts by regular people, who are doing more than we should ask of anybody.

And so I asked people watching to pitch in. I had talked with Jared again recently, and he had a couple of projects going where it seemed like folks with health-care IT expertise could really help.

And four or five people piped up. This was all on Zoom— they went into the chat and said, “me, me— I wanna help.”

Afterwards, the moderator of the panel started an email chain. And one of them wrote a note right away saying, “YES. This is so important.” We talked the next day.

Jeannine Cain: mean, I was so excited listening to you yesterday.

Dan: Jeannine Cain started her career working in medical offices, in the billing department— dealing with insurers who were denying payment. Then she worked for Blue Cross Blue Shield.

Now, she makes back-end apps to help INSIDERS deal with awful mess behind the scenes. All the data— including our bills— that doesn’t go where it’s supposed to go or do what it’s supposed to do.

And of course she had horror stories of her own to share. ONE of them was kind of a victory story.

And that’s the one I want to get into here. It’s about her son.

Jeannine Cain: this is like right at the beginning of COVID

Dan: So, March 2020. Her son is 20 years old.

Jeannine Cain: he was actually in Texas. We live in Alabama.

And he’s feeling sick.

Jeannine Cain: and of course I’m mom. So, you know, checking in on him every day. Are

Then when it got really bad and I’m like, Josh, you really need to get evaluated.

He goes, well, I don’t know how about I just wait a couple of days? I’m like, oh no, I don’t think so.

Dan: Because really bad isn’t just, he’s feeling crummy. His symptoms at this point— headache, fatigue, and a STIFF NECK— could mean bacterial meningitis. Which can take you out fast.

But where exactly is he supposed to go? There’s a pandemic.

Jeannine Cain: there was an order, everything was closed.

Dan: Jeannine is on the phone with him, she’s on Google, she’s trying to find someplace he can go. Which ends up being an ER.

And there’s good news. His diagnosis is…

Jeannine Cain: Other viral syndrome.

In other words, not COVID, not meningitis.

So, really good news.

You’re probably guessing the bad news: The bill is like 14 thousand dollars, and Blue Cross is like, We are not paying any of this. Under this policy, we only pay ER rates if you have certain diagnoses.

And not-COVID, not-meningitis?

Dan: Yeah, not a diagnosis we pay for. Glad you’re ok, kid. Go pay up.

Jeannine Cain: I mean, he was a 20 year old, overwhelmed saying, Oh my gosh, I have $14,000. my son makes $11 an hour.

Dan: Lucky for him, his mom is Jeannine Cain.

Jeannine Cain: I told him, I said, do not leave Texas without your medical records, that is, you know, what I do,

Dan: Right? She appealed insurance denials for a living. And then went on to work at Blue Cross. She knows how the game works, from the inside.

Jeannine Cain: All these companies are defining their own carve-outs of like what they cover and what they don’t. I mean, it’s almost impossible to navigate it. I it changes every year too,

Dan: Almost impossible to navigate. But not impossible for her..

She wrote a four-page letter. And it’s a masterpiece. The gist is: She told the story clearly. SUPER clearly. Tables, bullet lists.

AND She attached her son’s medical records, and the statewide orders that kept his non-ER options… severely limited. She linked to a CDC web page about bacterial meningitis.

Jeannine Cain: And then of course, CC-ing, the attorney generals and joint commission and insurance commissioner,

Dan: And it worked. Before long, Blue Cross wrote back: OK, you’re right. We were wrong. We’re gomma pay up.

Which, obviously, great: But it still took a LOT of her time.

Jeannine Cain: , when you’re working full time, you know, I mean, you can’t just stop the world to try and gather all of the information.

Dan: And then write that crystal-clear letter that makes the case. That takes time. Even for Jeannine Cain, who knows WAY more than most of us do. She probably knows more than most people who work in health care. And this was hard for her. I’m gonna post her letter— we can all learn from it— but I asked her

Is there like ONE thing you would want to share with anybody listening?

DAN is there something, you would want to tell people who was new show like this, like, Oh, here’s the thing you should know .

Jeannine Cain: Um, never really accept. No.

Dan: that is, that’s a good one. Yeah. Right,

for better or worse, that’s it. Never give up.

And: try everything. Because, did I mention that while she was fighting with insurance on the one hand, she was also talking with the hospital, making sure her son applied for charity care? She had to— she didn’t know FOR SURE that Blue Cross would come through.

The hospital was ready to knock half off. Which wouldn’t have solved the problem. Because if you’re making 11 bucks an hour, half off a 14 thousand dollar charge still means being on the hook for a LOT of money.

Jeannine Cain: to just say that, oh, well, we can only write off this percentage that really just floored me

Dan: Luckily, that wasn’t her best offer. Blue Cross did come through. But geez.

And look. We haven’t even talked about her other story. That one’s about her husband, who’s got cancer. That one? Talk about how you have to NEVER give up. That’s an ongoing nightmare.

This ER thing was just one bill, even if it was a big one. The cancer battle is all kinds of bills, from all kinds of players, for years.

Look, I get mad.

And Jeannine does too.

Even in her letter. Because that letter isn’t just cut and dry. There’s a fair number of words— even whole sentences— in boldface, sometimes all caps. Sometimes italics AND underlining too. One kind of long sentence starts “FOR THE LIFE OF ME I CANNOT UNDERSTAND WHY YOU ARE WASTING MY TIME” and ends with five question marks.

Jeannine Cain: I’m a little angry.

Dan: There’s also a whole page — just kind of a manifesto about how poorly designed the whole system is.

That’s why I’ve asked her to let us publish the WHOLE letter. And she’s annotating it— highlighting the magic words she used, spelling out why she put this information in a certain order. All of it.

And leaving in some of the stuff she wanted to leave out the first time I asked: The run-on sentences, the maybe kind of excessive use of all-caps.

Because there’s no single right way to do this. I’m not saying put five question marks at the end of every rhetorical question. I’m just saying: I think it’s comforting that someone who knows EVERYTHING that’s going on behind the scenes? She’s mad too.

Speaking of new friends: We heard recently from Kristen, in New Jersey. She was ALSO inspired by the story of Jared Walker, who used TikTok to show how to apply for charity care from hospitals.

She writes:

Kristen: “I just wanted to say THANK YOU for your episode featuring Jared Walker. After a bike crash and a trip to the ER last year, I was really freaked out by the possibility of getting a crazy bill. But after listening to your show about charity care, I checked the hospital’s website and I was at a certain percentage of the poverty level, and I knew I could apply! I did apply, and I received 100% financial assistance for that visit.”

Yes! Kristen, we hope you’re feeling better!

Seriously — one of the most exciting things about doing this show is hearing from you. You’re sending so many interesting questions, stories, ideas, and sometimes, if we’re lucky — like, REALLY lucky, because this is the American health care system we’re talking about — good news.

Thank you. You are keeping us going here.

Catch you in a few weeks. Till then, take care of yourself.

Latest Episodes

How to pick health insurance — in the worst year ever

Some things that didn’t suck in 2025 (really)

This health economist wants your medical bills

Looking for something specific?

More of our reporting

Starter Packs

Jumping off points: Our best episodes and our best answers to some big questions.

How to wipe out your medical bill with charity care

How do I shop for health insurance?

Help! I’m stuck with a gigantic medical bill.

The prescription drug playbook

Help! Insurance denied my claim.

See All Our Starter Packs

First Aid Kit

Our newsletter about surviving the health care system, financially.