A whole book about fighting effed-up medical bills? Yes, please.

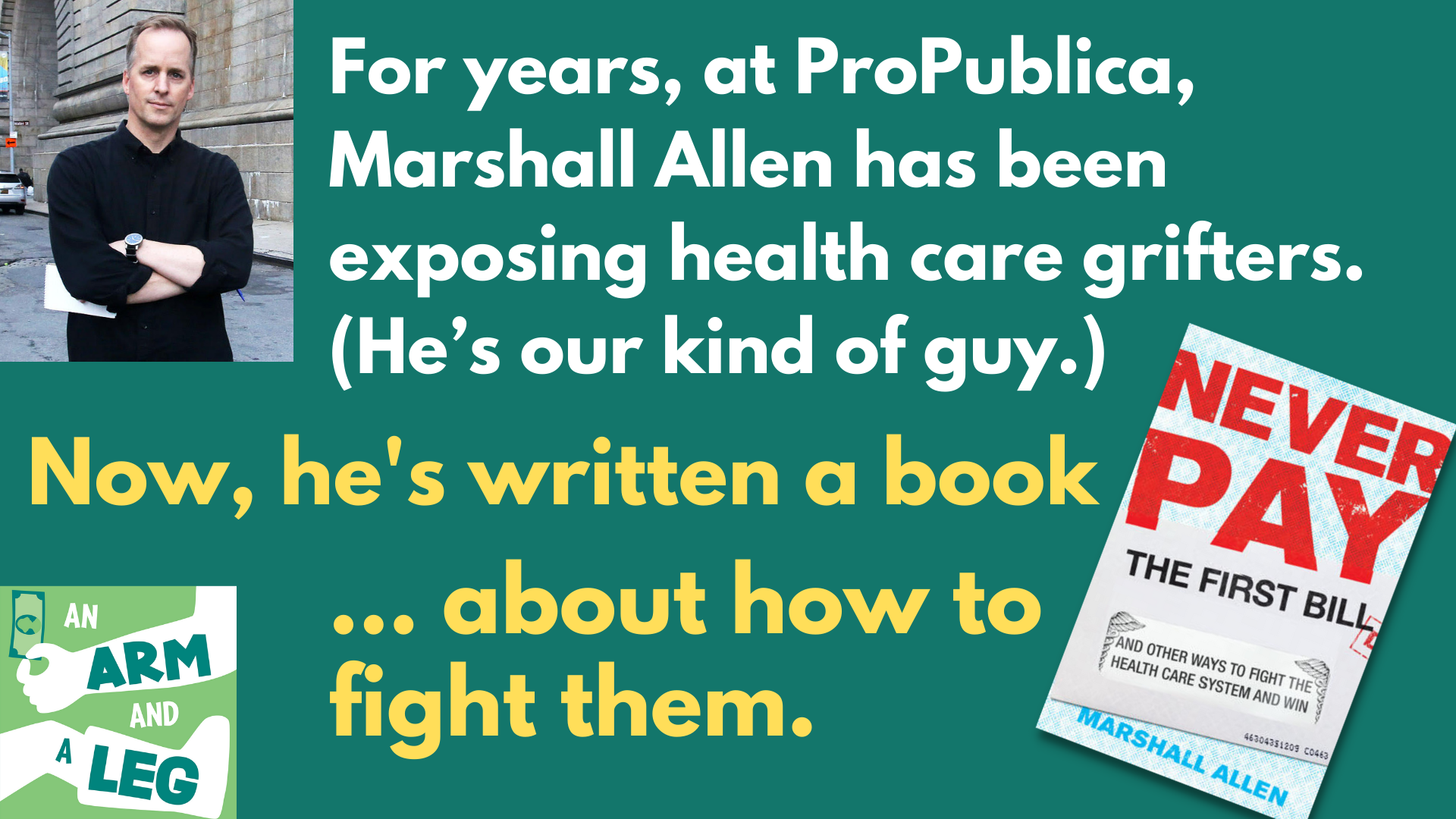

We talk with Marshall Allen about some of the best tips in his book Never Pay the First Bill; about how you can’t win ’em all, and about why it’s worth learning all you can and giving it your best shot.

Marshall compares the U.S. health-care “system” to the bully he faced in 7th grade. Big, stupid, mean. And SOMETIMES, as he learned in junior high, you can stand up to ’em, and not get stomped. Worth. Your. Best. Shot.

Marshall is a kindred spirit, we talked to him for stories in 2019 and 2020, and the conversation is a whole vibe. He shares some “magic words” that are worth memorizing or writing down somewhere.

Here are some magic words you can copy and paste, for if you ever end up in the ER. There’ll be a form they want you to sign, that says you’ll pay WHATEVER insurance doesn’t cover. If you can, X that out, and write in this instead:

I consent to appropriate treatment and (including applicable insurance payments) to be responsible for reasonable charges up to two times the Medicare rate.

(Why Medicare? Listen in for the details.)

Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG

And of course we’d love for you to support this show.

Dan: When Marshall Allen was in seventh grade, there was this 8th grader, a bully, that everybody knew to watch out for. At recess, he’d look for a target, then start a very-structured routine.

And this guy’s signature move was his big finish: Get the victim in a headlock, and spit in his hair. One day, Marshall was that victim.

Marshall Allen: He starts pushing me around. You want to fight? I’m like, no, I don’t want to fight. Oh, you think you can take me? No, I really don’t think I can take you. Well, it leads to. The, he puts me in the headlock and he spits on my head.

Marshall slinks off to the bathroom, wipes his head with a paper towel, hopes nobody really noticed. Next day, exact same. You got a problem with me? etc. Then.

Marshall Allen: puts me in the headlock

Dan: Day three, guy comes over, and something happens.

Marshall Allen: this was just instinctive, I did not even think about it , but I said to the guy, I was like, look, if you really want to prove to everyone else that you’re bigger than I am. You’re stronger than I am. You’re tougher than I am. Then prove it. Beat me up. If that’s the way it’s going to be, then do it, but do not spit on my head. And the thing that surprised me so much was that the guy goes, huh. And he turns around and walks away and he never bothered me again.

And that experience was in Marshall Allen’s head as he wrote a book— which just came out— that is a pretty terrific companion to this podcast. It’s called Never Pay the First Bill: And Other Ways to Fight the Health Care System and Win.

Hell. Yeah.

This is An Arm and a Leg, a podcast about the cost of health care. I’m Dan Weissmann— I’m a reporter, and I like a challenge, so my job on this show is to take one of the most enraging, terrifying, depressing parts of American life and bring you something entertaining, empowering, and useful.

And Marshall Allen is here to make my job a LOT easier. If you’ve been listening to this show for a while, you may have heard Marshall here before— a couple of times. He’s a reporter for ProPublica, and he’s been doing investigative reporting on health care for 15 years. We are kindred spirits.

An Arm and a Leg Transcript S5-Ep10-Marshall-Allen published Jun. 30, 2021 p. 2

In one of my very favorite stories ever, Marshall accepted an award as one of America’s Top Doctors— the kind of plaque you see in medical offices everywhere— even though he’s not a doctor. Turns out those awards are a scam. They’ll literally give one to ANYBODY— if you fork over two hundred bucks. Marshall’s got the plaque to prove it.

Of course a lot of Marshall’s stories are enraging, terrifying and depressing too. Which is why he’s written this book. He sees the American health care system as a version of that 8th grade bully.

And he’s here to say: Let’s stand up for ourselves. It may not work, we may get the crap beat out of us, but what the hell do we have to lose? They’re already spitting in our freaking hair.

And just like in Marshall’s junior-high schoolyard, there aren’t any grownups looking out. It’s a perspective you’ll find familiar if you’ve been listening to this show, and as you might expect, the two of us do just vibe out a bit.

Marshall Allen: the thing that I’ve, I’ve learned by doing these deep dives for ProPublica, is that your employer doesn’t actually know this stuff, your health insurance company, many people within that health insurance company are really good people.

They don’t really understand how all this works. There’s all these silos of information, right. And everybody has their own expertise, but really all these stakeholders are competing for our money. And to them, it’s just business as usual.

Dan: The way that I think of it is, that people respond to incentives

Marshall Allen: That’s right.

Dan: And everybody who works in the world of healthcare insurance, wherever their incentive, you know, is to keep their job

Marshall Allen: That’s right,

Dan: There’s what their moral compass might tell them to do, but their job is to do something else.

Marshall Allen: Right, And there’s a lot of virtue signaling that goes on within each of those companies to promote the healing aspect of the industry. Right. And I think the predatory financial side they are piggybacking on the trust we have in the clinicians are, you know, the doctors and nurses who care for us and everyone else.

And they’re exploiting the trust we have in our clinicians and our desperate need for, for healing and for care, to profit,

So, yeah: Marshall is absolutely a kindred spirit. And there is some great advice in this book. Y Marshall’s book is a how-to manual. He calls it a field guide to navigating the health care system.

Marshall Allen: This is not the stuff you’re going to hear at your company’s employee enrollment meeting.

Because (as Marshall just mentioned) whoever’s leading that meeting — describing how your employer’s health insurance works— doesn’t know what Marshall Allen has been learning.

So there’s a whole chapter on how you might be able to save money by *not* using your insurance.

Because as Marshall has been reporting for years, and we’ve covered here too (in an episode called Why Health Insurance Actually Sucks)

…, insurance companies make all kinds of weird deals with doctors and hospitals. Sometimes they agree to pay a hugely inflated price— and we can end up on the hook. Because we’ve got a high deductible— the amount we pay before insurance kicks in.

Or because we’re supposed to pay a certain percentage. And a percentage of a hugely inflated price could be a LOT.

So if you need a medical device, Marshall’s book reminds us, maybe you could buy it online. Sometimes a discount-drug service like GoodRx could get you a cheaper price than your insurance. And it never hurts to ask a provider: How much would it be if I just paid cash?

Marshall gave that one a shot, just for kicks. And he’s got good insurance.

Marshall Allen: I have very expensive, good insurance, which I’m thankful for. I’m very thankful. I’m so thankful. Um, but

Yeah, but. He picked a couple very common, basic lab tests— like a blood count and a metabolic panel— and called an independent lab near his home. First he asked how much he would pay with his insurance, then the cash price. In both cases, he would’ve paid three times as much by using his insurance. More than 60 bucks, versus about twenty.

HOLY CRAP. There’s a ton of hacks like that here. For all kinds of situations.

Marshall Allen: I knew I had to cover all these scenarios . What are the most common scenarios that create frustration with the healthcare system? That if I left this out, I’d be like neglecting the reader.

We’re not going to run through them all here. I mean, it’s a whole book. But here are three more — three sets of magic words— that made me think, “I SHOULD MEMORIZE THIS.”

First is for one of the worst-case scenarios: You’ve ended up in the emergency room. As we’ve talked about on this show, ER bills can be the absolute worst. They often include a “facility fee”— basically a charge just for walking in the door, that can be thousands of dollars. And the docs who work there often don’t work for the hospital directly— and often the outfit they DO work for… doesn’t take insurance. They can send sky-high bills of their own.

An Arm and a Leg Transcript S5-Ep10-Marshall-Allen published Jun. 30, 2021 p. 4

When you get seen, they ask you to sign a form called “consent to treat”: It says you want their treatment— and that you’ll pay for it, whatever insurance doesn’t cover.

Marshall advises x-ing out that paragraph and inserting this instead:

Marshall Allen: I consent to appropriate treatment and (including applicable insurance payments) to be responsible for reasonable charges up to two times the Medicare rate

Dan: Here’s why you mention Medicare.

Marshall Allen: the Medicare rate is set by the federal government. It’s always going to be a lot lower than what a commercially insured person would pay. Typically lower also than what an uninsured person would pay.

In bad cases, hospitals charge 5 times the Medicare rate or more. That’s what you’re protecting yourself from.

Or trying to. Some hospitals don’t give you a piece of paper—they have you sign on a screen— so there goes your chance to x things out.

But Marshall says he’s seen it work. It’s worth trying. So here it is again:

Dan/Marshall I consent to appropriate treatment and (including applicable insurance payments) to be responsible for reasonable charges up to two times the Medicare rate

White that down in your phone somewhere. We’ll post these magic words wherever you’re listening, so you can copy and paste.

Oh, and Marshall says, if you do end up using them, use your phone to take a picture for your records. Two more sets of magic words:

One comes from a woman named Laurie Todd, who calls herself The Insurance Warrior. She appeals insurance denials for stuff like cancer treatment, and she does not fool around. Marshall’s got a whole chapter on her.

Marshall Allen: she blew my mind. This woman? All I could say in my book is buy her book.

Dan: I have bought it.

Marshall Allen: It is so good. And you have got to have her on your show.

Dan: Note: I have invited her.

Marshall Allen: a, you will love her. She is a force of nature

Dan: So that’s something to look forward to. Meanwhile, one tip in particular— magic words— made Marshall, as an investigative reporter, take note and say, “I’m gonna use that one in my job.” Made me say the same thing.

It’s for when you’re working on reaching a bigwig. A higher-up. And it’s this: Never leave a message. Instead, if someone offers, you say, “I prefer to call back.”

Marshall Allen: psychologically, you just maintain the power position. When you say I’m going to keep pressing. And persisting until you call me back, leaving a message. She calls it a felony, never leave a message.

I like that! Finally, Marshall’s got a magic phrase of his own. This one’s for if you’re negotiating with someone who wants money — like a bill collector. Marshall’s got a chapter on that too, of course.

That chapter also includes a magic piece of data I hadn’t seen before: Hospitals sometimes sell old debts to third parties, who have the right to keep whatever they collect. Marshall found out how much those third parties pay: two to five cents on the dollar. So if you’re on the line with someone like that, he says they might accept just 15 percent of the total. That’s a good return for them.

That data? It gives heft to Marshall’s magic phrase: I’m sure we can come to an agreement that works for both of us.

He says it’s the advice he gives young journalists negotiating a job offer.

Marshall Allen: When they make that first offer, do not say yes right away. Tell them you’ll get back to them the next day. Tell them, thank you very much for the offer. I’m so excited. I’m sure we will come to an agreement that works well for both of us. And what you’re signaling there is that you’re not creating an ultimatum where my way or the highway, you’re not creating a confrontation, but you’re signaling to them. It needs to work out for me too.

Huh. I mean, I like that a LOT.

There’s a TON of stuff in Marshall’s book like that. Encouraging, smart, useful, hopeful. But it’s not always such a comforting read. More on that in just a minute.

Dan: This episode of an arm and a leg is a co-production with Kaiser health news. That’s a nonprofit news service covering health care in America. Kaiser health news is not affiliated with the big healthcare outfit. Kaiser Permanente we’ll have a little more information about Kaiser health news at the end of this episode.

So Marshall Allen’s book Never Pay the First Bill is full of smart advice.

And I’ve gotta tell you. This book is not always easy reading. The heart of it, the meatiest, advice-y-est chapter— the one that walks you through how to deal with a medical bill that seems out of line— man, I found it tough going, a little overwhelming.

If you’ve been listening to this show for a while, a lot of the advice Marshall gives in that chapter will sound a little familiar: Get an itemized bill, learn to read the procedure codes, learn to read your insurance paperwork, compare everything, call everyone, negotiate, be patient, escalate, all the stuff.

Seeing it all laid out, it’s a LOT. Especially because you never know how it’s going to go.

Trying to deal with a medical bill is like trying to deal with your computer when it’s doing something annoying or terrifying. Maybe you just need to turn it off and turn it back on again. Or maybe you’re gonna need to buy a new computer. And the amount of time you could spend figuring it out— who the hell knows?

And a new computer is cheap compared to most medical bills.

So there’s the bright-side version. Marshall got a bill once for $250 bucks after an urgent-care place treated his son. and looking at the bill, it kinda looked like they might not have billed his insurance first.

Marshall Allen: I call the insurance company , took five minutes at the most .

I get on the phone, they look it up. They say nothing was ever submitted from this clinic. I called the clinic billing office and I say, Hey, I called my insurance company. They said, you didn’t run this through my health plan. They were like, oh yeah, it looks like, uh, something went wrong with the submission of it or something like that. We’re not saying any mistake was made. And I’m like, whatever, I don’t need to judge you just please submit it to my insurance. And don’t bill me. So right there in five minutes, I’ve saved $250.

So there it is. Maybe it’ll take five minutes. Or maybe it’ll take months, like a story Marshall tells at length in the same chapter, about a woman who spent months fighting a $323 charge for an exam that she knew never happened.

Months. She appealed to her insurance company’s fraud department, and to three different state agencies. And she persisted with all of them to make sure she got a response. And in every single case, the response was: Yeah, no, we’re not getting involved here.

Eventually, she got the hospital to waive the charge, but geez.

And sometimes you can do all that and still hit a total dead end.

Marshall Allen: in many cases, there’s nothing you can do.

Dan: You know, everybody’s situation is so unique. In many cases, there’s not. A solution. There’s not a fix. In fact, my own mother called me after reading the chapter on how sometimes it’s better to pay cash, then run something through your insurance plan.

My mom calls me up. And she goes, Hey, your cash thing. Didn’t work. I’m like, what mom, what, what do you mean? She’s like, it didn’t work. I tried to pay cash and they told me it would cost more. I was like, well, mom, if you read the chapter, it says, sometimes you can pay less with cash.

But that doesn’t mean that it’s always going to be better. Sometimes it is. And many times it won’t be, but if you don’t ask, you won’t know.

Dan: It is a lot. I mean, I’m a fine one to talk, but seriously, a whole book? I had to take a lot of breaks.

Which is why I love this OTHER thing that Marshall’s doing. He’s going into business, turning the tips in his books into a series of short videos employers can share with the workers they insure. Marshall says the idea came from someone who consults with companies on health benefits:

Marshall Allen: he said, look, I have all these employees in my health plan.

I know they’re not going to read a whole book. And I understand that too. He said, would you create some videos based on the book?

Dan: Marshall said sure. Now there are videos, and — for an extra fee— an app, and some other extras. It’s a monthly subscription per-employee.

It puts Marshall in what I might call a grey area. He’s been writing for years about how employee benefits plans consistently fail to protect the people they insure— and often waste a lot of the employers’ money. He’s highlighted insurance brokers and “employee benefits advisors” that do things differently— which is already a little delicate, as he admits—

Marshall Allen: it’s a fine line to walk as a, as a journalist where You want to say like, Hey, look, this is the way somebody is doing it. That’s different. , That’s a success. But you want to do it in a way that isn’t saying, Hey, I’m Marshall Allen, and I’m telling you to go use this particular service.

Dan: and now those services will be connected to his business

Marshall Allen: Yeah. So I had to meet with, my editors. Our attorney, all that to figure out, to sort through can this work? Like, am I allowed to do this? And then if I can, what’s the way to do it so that I walk that line where I can still cover healthcare, but not be conflicted.

Dan: Yeah. Yeah. Did they say, I believe we can figure out a way that works for both of us.

Marshall Allen: They actually, I was, they really liked the idea. They were like, go for it. Just, don’t just don’t cover any more of the benefits advisors and you’ll be fine.

Dan: I’m glad Marshall and his editors and their attorneys got to yes there, because I definitely want Marshall and his business to be SUPER-effective.

If he can get employers to educate their HR people and their workers on ways to avoid getting ripped off? I am SUPER here for it.

This is a non-system— it’s just a giant jumble of broken pieces. [Broken for us, they work great for the folks who make money from them. ]

There’s room for— there’s need for— lots of efforts. All we can get.

So, you may have heard me say: I am interested in rolling up my OWN sleeves, finding a way to bring more of us together, to learn together, to help each other out.

I’m inspired by what Marshall is doing, and by what folks like Jared Walker are doing— he’s the guy we profiled early this year, who went super-viral on tiktok educating people on how to apply for financial assistance from hospitals. I caught up with Jared last week.

Since I first talked with him in January, he’s done a LOT. With the help of dozens of volunteers who have showed up. And he says the best ones? Tell him they heard about him on this podcast. I can’t tell you how happy that makes me. I am so proud of you.

I’ll have details for you next time about what Jared and those volunteers are up to. Till then, take care of yourself.

This episode of an arm and a leg was produced by me, Dan Weissmann. Edited by Marian Wang. Daisy Rosario is our consulting managing producer. Adam Raimondo is our audio wizard. Emily Pisacreta is our intern. Our music is by Dave Weiner and blue dot sessions. This season have an arm and a leg is a co-production with Kaiser health news.

That’s a nonprofit news service about healthcare in America an editorially independent program of the Kaiser family foundation. Kaiser health news is not affiliated with Kaiser Permanente. The big healthcare outfit this year, an ancestor, this guy, Henry J Kaiser. He had his hands in a lot of different stuff, really different. He paved roads, built a big chunk of the U S cargo fleet for world war II made cars, including the Jeep also made aluminum foil. When he died more than 50 years ago, he left half his money to the foundation that later created Kaiser health news.

You can learn more about him and Kaiser health news at armandalegshow.com/Kaiser. Dan Weber is national director. Diane Webber is national editor for broadcast and Tanya English is senior editor for broadcast innovation at Kaiser health news, they are editorial liaisons to this show. Thanks to public narrative. That’s a Chicago based group that helps journalists and nonprofits tell better stories for serving as our fiscal sponsor, allowing us to accept tax exempt donations.

You can learn more about public narrative@wwwdotpublicnarrative.org,

And as always, thanks to everybody who is making those donations: You are keeping this show going. And if you’re considering pitching in, of course we’d love that. You can do it at arm and a leg show dot com, slash, support.

Thank you!

Latest Episodes

NYT’s Ron Lieber: ‘These people are not going to win’

‘Sh**’s wild’: Scaling up, doubling down, and buckling in

Our favorite project of 2025 levels up — and you can help

Looking for something specific?

More of our reporting

Starter Packs

Jumping off points: Our best episodes and our best answers to some big questions.

How to wipe out your medical bill with charity care

How do I shop for health insurance?

Help! I’m stuck with a gigantic medical bill.

The prescription drug playbook

Help! Insurance denied my claim.

See All Our Starter Packs

First Aid Kit

Our newsletter about surviving the health care system, financially.