A tool for avoiding hospital bills you can’t pay

Hey there,

It’s no mystery: The size of your hospital bill depends a lot on where you get care.

You already know: You’ve gotta check that your insurance actually covers any hospital you might go to.

And you know: Even with insurance, bills can be huge.

A “safety valve” for a lot of people — one of the most important tools we’ve ever learned about — is charity care, sometimes called financial assistance: hospitals forgive bills — or give deep discounts — to people, based on income, at just about every hospital.

But every hospital sets its own charity care policy: What’s the income cutoff? Can people with insurance get charity care, or only the uninsured? The answers can be dramatically different from one hospital to the next.

Now, thanks to a new report and an interactive tool from a health care think-tank called the Lown Institute, you can look up which hospitals in your area actually have policies that would help you.

Meaning: You can see which hospitals are least likely to leave you stuck with a bill you can’t pay.

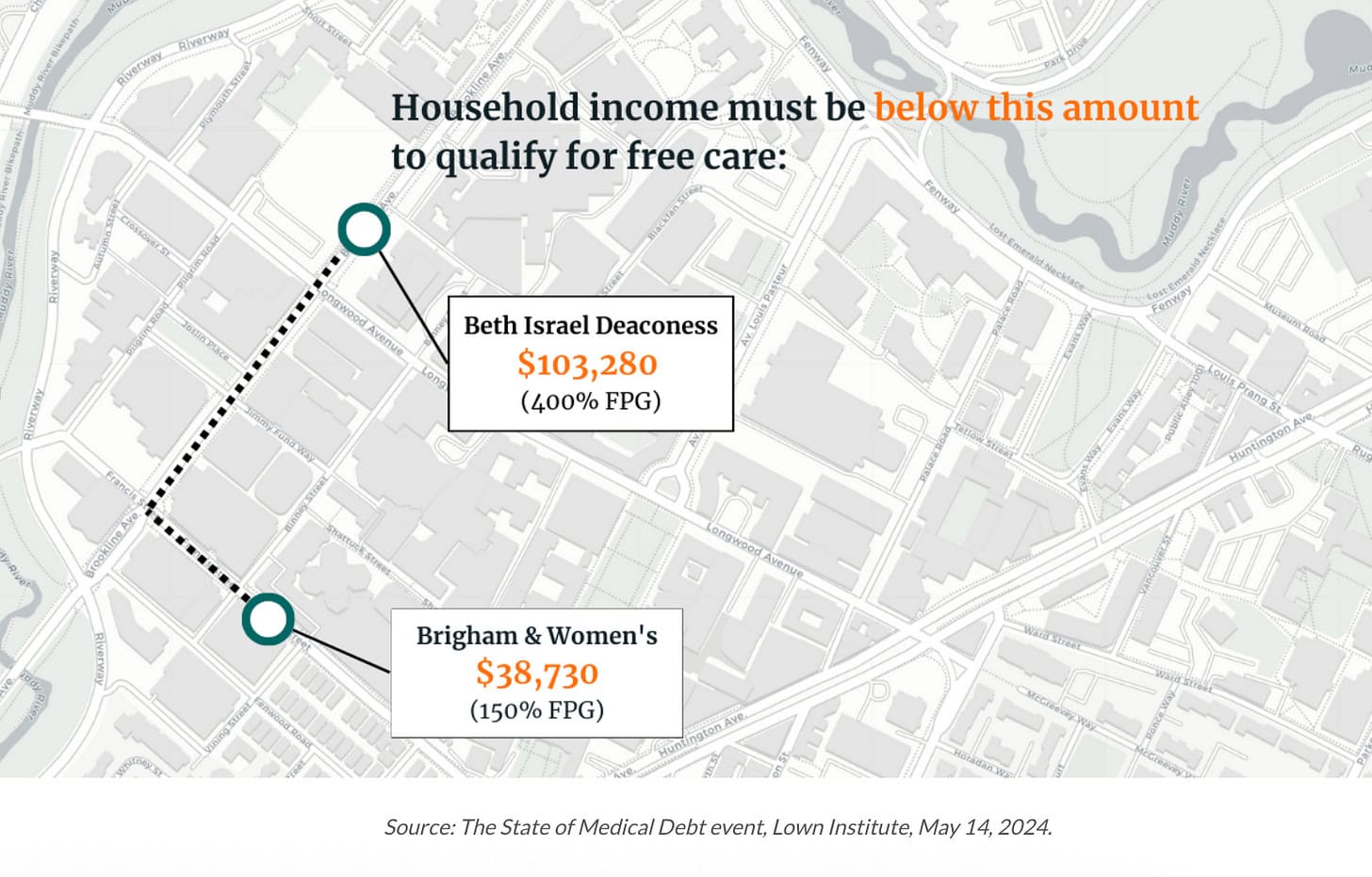

How a short distance can make a huge difference

The Lown Institute collected charity care policies from 2,500 hospitals across the country. (These are the same folks who brought us the Shkreli Awards, “honoring” health care’s worst examples of greed and dysfunction.)

Their findings show just how dramatic the difference between hospitals can be — and how clutch this information is.

As an example, they looked at two hospitals in Boston, The income cutoff for free care at Beth Israel Deaconess is almost three times higher than at Brigham and Women’s, just a few blocks away.

As Judith Garber, a Lown Institute policy analyst notes, this means “turning left or right at an intersection can be the difference between going into medical debt for thousands of dollars, or not.”

But Lown didn’t just compile this data. They made an online tool you can use, to decide whether to turn right or left.

Here’s how Lown’s charity care tool works

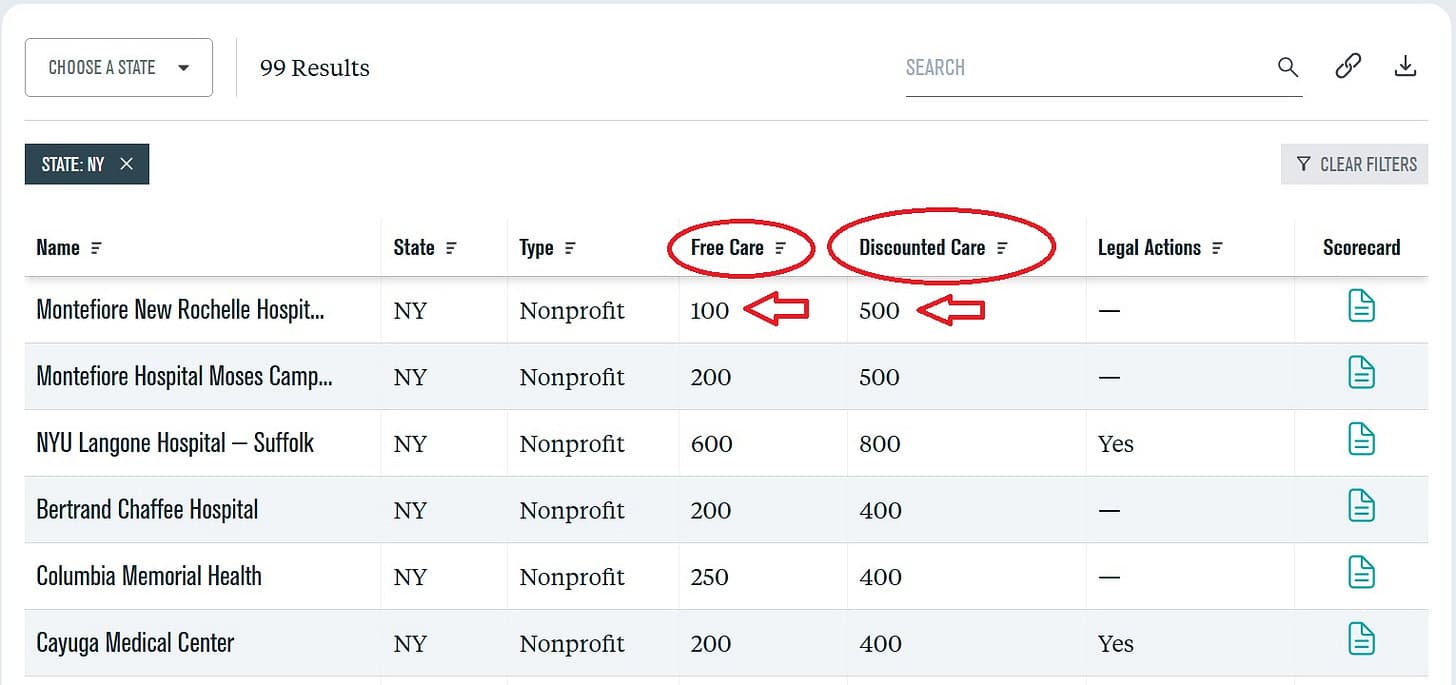

The first thing you’ll see is the start of a very-long list of hospitals. And notice: You can narrow it down by state.

For my home state, New York, it shows 99 hospitals. Now to evaluate them — to figure out which hospitals might actually consider me qualified for charity care — I need to do a little nerdy math.

You’ll see we’ve got columns here for “Free Care” and “Discounted Care” — but what do the numbers in those columns mean?

Nerdy answer: They’re income cutoffs, but laid out as percentages of the federal poverty level. So “100” here means: Exactly the federal poverty level. “500” means 500 percent: five times.

Hospitals list these percentages rather than just using dollar figures because: the actual dollar figure for you depends on how many people are in your household. For a single person, 100 percent of the federal poverty level is $15,650, but for a family of four, it’s $32,150.

So, to find the hospitals that might give you help, you’re gonna want to figure out where your household size and income puts you — using this handy calculator.

But wait, it’s not only about income cutoffs

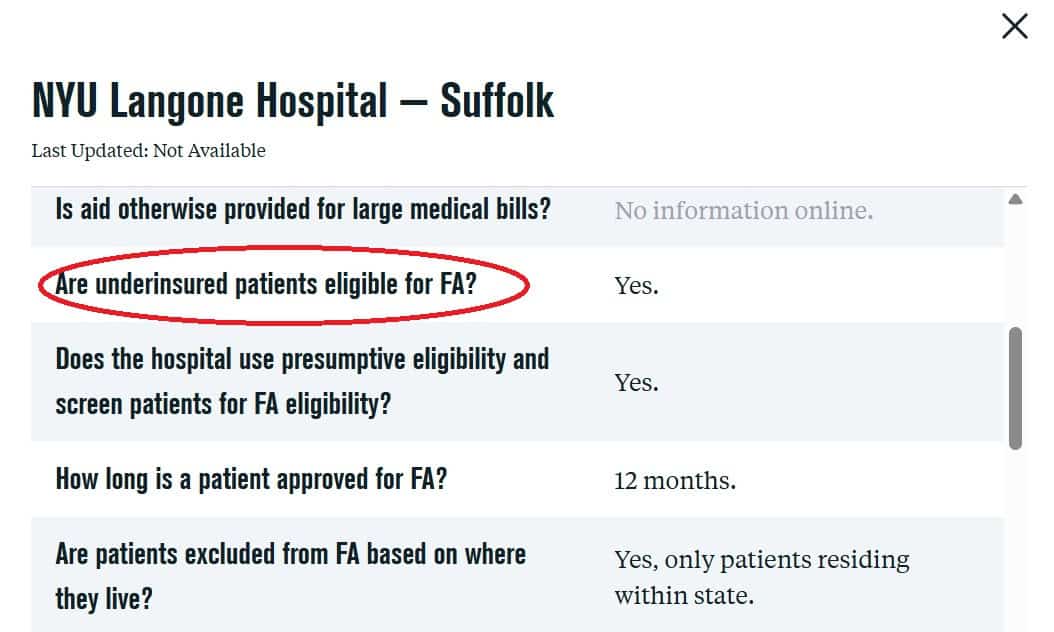

Lown also gives a “scorecard” for each hospital, with more details. Here’s an example of the scorecard for NYU Langone-Suffolk, where I’ve circled a key detail:

That question, “Are underinsured patients eligible for FA?” translates to:

If I have insurance, can I still qualify for charity care?

…and here the answer is “yes.”

Other details here could also be worth looking at, including the last question in that screenshot: It says “only patients residing within state” qualify for charity care at this hospital. If I live in New Jersey, a couple hours away, I’d be out of luck here.

A couple of caveats (of course):

- Hospitals can make lots of carve-outs to their policies, and these summaries from Lown may not capture all the fine-print details.

- The Lown tool is based on a one-time snapshot — what these policies looked like in spring 2025. Any given hospital could change its policy at any time.

So you may want to do some additional fact-checking: Google [hospital’s name] + “charity care policy” to find the current policy, read the fine print, and call the hospital if you spot ambiguities.

Ask for “charity care” by name. Right away.

This is a big, red-light warning from the folks at Dollar For, a nonprofit that helps people access charity care. They’re basically the country’s leading experts, for if/when you ever do get a hospital bill.

As Dollar For’s founder Jared Walker told us, “financial assistance” may technically mean the same thing as charity care — like, they show up interchangeably in government policies — but folks at hospital billing offices don’t always think so.

A billing rep may say, “Yeah, we’ve got great financial assistance options…” and then steer you to a payment plan — often administered by a third-party, like CareCredit or Access One.

Do not let that happen. As Jared’s colleague Eli Rushbanks told us this week, getting signed up for one of those third-party plans could make it almost impossible to apply for charity care later.

Financial assistance staff need a “bill” to forgive, and once a third party has taken over the bill… sometimes the hospital says they can’t access it anymore.

“The patient’s financial assistance application is then effectively denied,” Eli wrote, “on the basis that there’s no financial assistance to grant without an outstanding bill.”

So when you’re ready to apply for charity care, call the hospital’s billing office and ask about charity care by name.

And whatever you do, don’t agree to a payment plan managed by a third party like CareCredit without first applying for charity care.

And in general beware of these products because, as we’ve reported on the podcast, while they sometimes tout “zero-interest” terms, if you miss a payment or don’t pay it off quickly enough, you can get socked, hard.

If you need assistance with your charity care application — especially if you run into a sticky situation — Dollar For has staff who can help you, for free.

Finally, if you get a charity care application denial, here’s a template a listener made for appealing.

That’s all from me for now.

— Claire

Get the First Aid Kit Newsletter!

First Aid Kit

Get our latest tips for dealing with the healthcare-industrial complex.