COVID tests are free, except… when they’re not

Anna’s insurance company said it would pay 100 percent for COVID-related testing. And then they left her to pay a giant bill.

She got help, thanks to a viral tweet, but… her story exposes big loopholes in consumer protections. (We learned how not to fall in.)

And: the way people responded to her tweet was generous, moving, and… complicated.

Uncomfortable. Weird. Even painful, even with everybody doing their absolute best. (And, we should say, with as happy an ending as any of us get these days.)

The story gets right to the heart of some of the really weird ways that dealing with the cost of health care , ESPECIALLY in the world of COVID-19 and the Internet and everything else , just messes with our minds, and our relationships as humans.

Dan: Hey there. A couple weeks ago we explored a question we got from Becky in Minnesota, which was, if I got COVID, what good would my insurance do me? And if you caught that episode, you might remember one takeaway was actually kind of cheerful for this show anyway, as in CO relief laws, Congress passed in March.

Actually give consumers some protections limits on what providers can charge requirements for insurance companies to cover COVID testing and COVID related testing. A hundred percent. You might also remember that the federal guidelines telling hospitals and insurance companies how to interpret those new laws were still coming out and experts were still digesting those guidelines.

Like the night before the podcast came out, we had to do an emergency interview with Sabrina Cort, who runs Georgetown University’s Center on health insurance reforms. ’cause all that stuff had just changed. How unusual is it for you to have these kind of giant policy changes kind of coming like, oh, and then it, then this happened on Saturday then, and then there’s this new guidance as of Monday and hey, it’s Tuesday.

Um, how unusual is that for you? Well then add

Sabrina: on top of that, yeah. The 50 states that are putting out new guidance every single day. Um, so it’s, uh, it’s a little overwhelming.

Dan: So a few hours after the podcast came out, I got a note from Sabrina. She was forwarding me some new analog. Like knew that morning from a colleague of hers and it said, Hey, you know, that requirement that insurance companies fully cover COVID related testing, uh, there may be kind of a loophole.

I looked at it and I thought, uh, damn. Do we have to update the story now like a again, ’cause we were a pretty late last night. And I was like, no. Everything that we put in the story is still true and this loophole, how often is it gonna come up? Okay, let’s just say it has come up.

This is an arm and a leg. It’s a show about the cost of healthcare. I’m Dan Weissman and I did a version of this week’s story for NPRs Bill of the Month series. That’s a collaboration they do with our pals at Kaiser Health News, and if you caught that, you will find a little more detail in the next five minutes and some brand new stuff after that.

If you’re new here, welcome. You have joined us a few episodes into season 19. It’s our fourth season, but we’re naming it after COVID-19. Uh, yeah. Uh, you might find the last three episodes pretty darn interesting. Alright, here we go.

If you were gonna pick somebody who might be able to handle themselves in dealing with a weird medical bill, you could do worse than to pick Anna Davis Abel in West Virginia. She’s a grad student. That’s a flexible job, and she’s got no kids, so she has plenty of time to stay on the phone. Haggling with insurance.

And she’s got a special qualification for a year after college. She worked in a doctor’s office.

Anna: Part of my job was that whenever we had to get prior authorizations for like MRIs, we’d have to call the insurance company.

Dan: That is, she used to haggle with health insurance companies for a living, and she knows things about insurance and billing codes that make the rest of us go numb with confusion and fear.

And if you were gonna pick somebody who really needed a COVID test last month. She’d be on your shortlist there too. She had just been on a plane and she had classic COVID symptoms, rising fever and dry cough. That kept getting worse.

Anna: I had been like mainlining Mucinex. I was like, why am I so sweaty? I feel like a man, like no offense, I am not pleased.

Dan: And she has lupus. That’s a chronic disorder. That means any potentially serious illness poses a special threat to her. Her doctor said, yeah, you better come in, but. When she showed up, her doc said there were hardly any COVID tests in the state of West Virginia to get one for Anna, they would have to

Anna: prove, you know, beyond a reasonable doubt that it was nothing more common and more viral.

Dan: So Anna got a test for flu and for other respiratory illnesses, and it came back positive for flu. A week later, she was still super sick and her doctor said, new science was showing that COVID sometimes piggybacks on the flu. On her doctor’s recommendation, she got a drive through COVID test. Those were now available, and that nasal swab was no fun.

Uh, and it documented it on Snapchat.

Anna: Oh my God, that woman took my soul out of my head with that Q-tip. She actually grabbed the back of my head like we were lovers, but instead of kissing me, she was impaling my brain.

Dan: It turned out that was not the worst of Anna’s problems that day. Later she got a statement from her insurance company about that first virus test,

Anna: And I was like, you know, this, this COVID stuff is supposed to be covered.

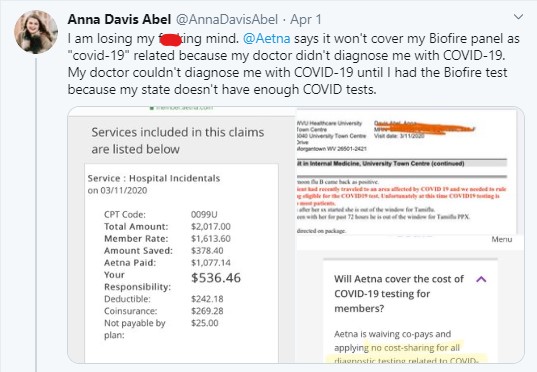

I wonder how that looks. And, uh, lo and behold. My insurance company was saying that I owed $536, and I think 47 cents,

Dan: actually 46 cents. And this was her share, the statement said of a $2,000 charge for that test.

Anna: At first, I was like, oh, this just, you know, it just messed up here, LOL guys.

Dan: But when Anna called Aetna, the person on the other side of that call and the many calls that followed, told her.

That wasn’t a mistake. The billing record, it didn’t include a COVID specific diagnosis code.

Anna: And even though my doctor had put in written words

Dan: like

Anna: this is a part of COVID-19 testing in our state, the person on the other end of the line was not able or allowed. I mean, one of them actually said, I’m not allowed to look at that,

Dan: and I got more and more angry.

Anna: I told the Aetna representative multiple times. I said, look, I’m gonna go and make sure that someone hears about this.

Dan: She did everything she could. She contacted elected representatives and the state insurance board, and she went to Twitter. She attached her medical record and the insurance statement to a tweet that started, I am losing my mind.

Somebody with a big following retweeted her and that got results. More than a thousand retweets. And she heard from a reporter who made his own calls to and that got the company’s attention.

Anna: Within 20 minutes of the reporter emailing me back saying that he had spoken to them, I got a call.

Dan: This was an Aetna rep farther up the chain who said she’d be overseeing Anna’s case.

Anna: She was like trying really hard. To be personable and was talking about like her dogs at her house and

Dan: Anna was not having it.

Anna: Ordinarily it would blanch the southern out of me to be rude when someone is trying so hard to be personable. But like I, I had been trying to be a person with these people for weeks.

Dan: The woman told Anna Aetna would pay the bill in full, and they did. Aetna would not go on tape with me, but by email, a representative said. The information that Ms. Abel’s healthcare provider shared with us initially did not code the service as related to COVID-19. It’s not clear that appropriate codes existed when Anna got her tests.

Aetna’s statement called Anna’s case, unique meaning, and I ask that no other Aetna customer has had to pay for a test they got in order to get a COVID test.

Anna: I highly doubt with all of my doubting skills that I’m as unusual of a case as Aetna has claimed.

Dan: Yeah, honestly, me too. And later I’m gonna ask you for your help and seeing if we can fact check them a little on that.

But first. What does the law have to say about any of this? I talked again with Sabrina Corlett. She runs the Center on Health Insurance Reforms at Georgetown, and she says, when Anna got that first test, no federal law required insurers to give extra coverage for these kinds of tests. Later in March, a week after Anna’s first test, Congress passed laws directing insurance companies to fully cover COVID related testing.

So. That would’ve helped Anna. Right.

Sabrina: Well, this is where I’m gonna get super lawyerly on you. Mm-hmm. And your audience is gonna just wanna like shoot me with daggers. Um, if the doctor had ordered her an influenza test and a bunch of tests to rule out all sorts of other conditions. And also a COVID test in the same visit, then that would be covered.

So if I could have turned back time and sat in that doctor’s office, I would’ve said just order the test, even though, even though you know, it might be a long time before she can get it.

Dan: Wow. And this is if we could really manipulate time and move the visit. Forward in time to the point where that federal law applied, and then you could move backward in time to that date and, and, and deliver that message, right?

That that’s what that should require.

Sabrina: Oh, that’s sort of a mind bending thought, but yes.

Dan: But in this world today, we still need someone like Sabrina in a lot of doctor’s offices handing out this knowledge.

Sabrina: Well, I would expect most doctors don’t know that if they don’t actually order a test. At the moment of the first visit, that their patient could be exposed to these out-of-pocket costs.

Dan: So the lesson is like, Hey, tell everybody, you know, if you go in because you’re concerned, you might have COVID to 19, and the doctor’s like, I can’t give you a test. Say like, doc, put an order for the test in my chart for today. Otherwise I could get socked from my whole deductible and gosh knows what else.

But if you put an order in. Then I am protected. Right? These are like magic words.

Sabrina: That’s what the federal law says.

Dan: Yeah. Bam. That is so useful. So tell everybody you know, you’ll be helping them out, man. We have covered this legal loophole thing pretty hard. I feel good about that. And there’s actually all this other stuff in Anna Davis Abel’s story.

It gets right to the heart of some of the really weird ways. Dealing with the cost of healthcare, especially in the world of COVID-19 and the internet and everything else, just messes with our minds and our relationships as humans. When Anna’s tweets got all that attention, it was not just a reporter who got in touch.

There were also two people who DMed her offering to pay her bill, and that got. Complicated. Like really nice, really moving, and also even with everybody doing their absolute best, a little uncomfortable and weird, and when you get down to it painful, that’s right. After this.

This season of an Arm and a leg is a co-production with Kaiser Health News. Kaiser Health News is an independent newsroom reporting on healthcare in America, and it is not affiliated with the giant healthcare provider, Kaiser Permanente.

There’s a little more detail on Kaiser Health News at the end of this show.

So when Anna tweeted her medical records and her insurance statement and went viral, she got messages from two good Samaritans who wanted to help out financially, which, you know, wasn’t what she’d set out to do.

Anna: Oh my gosh. That was a hundred percent. Not my intention.

Dan: She had just been looking to roast Aetna, but she wasn’t really in a position to say No, 536 bucks.

It is a lot of money for Anna. Her paycheck is three 50 a week and she already had a few thousand bucks in medical debt. Anna had surgery last summer. She wound up with some unexpected bills. The interaction was a little awkward right away. These people were strangers. I mean, how is this even supposed to work?

Anna: So I asked, you know, do you want my medical account number or like, what? What would be best? What would you feel most comfortable with?

Dan: Both of them were like, I’ll Venmo it to you, and when did it right away

Anna: I went and I paid like the exact amount of the test and sent. The, the man, like a screenshot of like, this has been paid.

Dan: And by the time Anna had done that, the second person had Venmo her too. It was like double booking yourself on a date or something, but somehow weirder. And Anna got in touch with the second person.

Anna: I was like, look, I’m gonna be really honest with you. Someone else literally just paid the cost of the test,

Dan: but she wrote, I do have this other big medical bill that I’m paying off.

Uh, do you want me to send this money back to you? I mean, it’s in my Venmo account.

Anna: And thankfully she was like, no, no, it’s yours. Use it how you want. So I then paid another $530 towards my medical bill and sent her that screenshot. And of course it was like, so touching. They don’t know me. They were not people who followed me.

You know, we had no overlapping anything. They had no reason, but just out of the kindness of their hearts, they wanted to do it. And I, I still, I, I’m hopeful that one day maybe I’ll be able to do the same for someone else.

Dan: So we’re in some unusual territory here. And then there’s this whole other layer of complication, which is of course, that.

Aetna eventually turned around and paid the bill for Anna’s test, but they didn’t give Anna the money. They sent it to the hospital. And remember how Anna’s paying off thousands of bucks for surgery she had last year? It’s the same hospital, so the hospital has the money, and they’re like, great. Hey Anna, we’ll just put all this toward your other debt so Anna can’t return this money to her first benefactor, the one whose money actually paid for the test.

It’s not like she had an extra 500 bucks sitting around to begin with. And so she got in touch.

Anna: I was like, if you would like the money back, I can, like, I’m willing to set up like a payment plan with you. I don’t have it in my possession to just give it back to you as the total amount. Oh my God. But I also, you know, I don’t wanna be dishonest And um, thankfully he was like, what a pay, no, you’re not doing a payment plan.

Like, no, like you can keep it for your expenses. Um, oh my gosh. You know. Don’t worry. I was really thankful that they were, you know, fine with it. Just going towards this other bill that I have with the hospital instead of the first,

Dan: but I mean, awkward. And more than that, I told Anna, you know, it’s emotional for me to hear these parts of the story.

The generosity, that act of accepting you could really use the help, the negotiating, all of it. Like on Twitter, random people communicating 280 characters at a time, sending money, sending thanks into the ether. And something about that awkwardness is also just painful to hear about.

Anna: You know, I was talking to my husband afterwards and I was kind of embarrassed.

You know, it’s like we had this, what is it called? We’re all embarrassed millionaires in America. Like temporarily we all think, you know, oh, I’m not really in debt, like I’m gonna win the lottery or like that. There’s almost like shame in. Needing help. Yeah. But the system, especially with medical bills, it relies on that shame.

Like it relies on us to not admit that this is an astronomical amount of money. I have been charged for something over which I had zero control. And so then one of the only bits of control we end up having is the control of acting like it’s not gonna break us.

Dan: Anna says she sees that shame operating in her community right now. The local paper just broke the news that the local hospital, the same place. Anna got that expensive test in the same place she had the surgery last year. The only hospital in town has been seizing people’s bank accounts when they’re behind on payments and garnishing their wages.

And I saw the news on a local Facebook page

Anna: and the comments on it were people shaming, the people being turned over to collections. You know, like it was like, pay your bills. This isn’t someone who, you know, was living above their means, whatever that even means, but like they just got sick.

Dan: Now, of course Anna has a head start on a lot of people in piling up bills for an illness she didn’t ask for.

Lupus is a lifelong thing and it costs a ton of money. She’ll be paying off that surgery for another three years. And is the hospital charging you interest on this payment plan you’re on with them, by the way? Uh,

Anna: no. That is one fantastic, um, option. The reason I haven’t just gone ahead and like put it all on my credit card is because, at least in this way, I’m going all towards the principal and there’s not an, there’s not interest.

Dan: Yeah, right. Screw that. Yeah, it’s, yeah. I mean, it hurts my heart to hear you call it fantastic. You know, it’s like fantastic. If we have to be grateful that they’re not charging us interest on the enormous amounts of money they’re charging us, you know, that’s, that’s bad.

Anna: Yes. Thank you. Thank you for being only slightly terrible to me.

Yeah,

Dan: yeah. Thank you for allowing me to, to pay you all this money without also juicing me for interest. Yeah.

Anna: Yeah. And it’s, it’s one of those things that I try not to think about too hard because it just beats you down. ’cause part of the reason that my. My surgery was so expensive was because, and it was such a small error.

Dan: Yeah, I get this. Her insurance had approved this one medication for injections, 50 milliliters each. But on the actual day of the surgery, the doctor did two injections of a hundred milliliters, and the insurance was like. That’s not what we authorized and they denied it, which cost Anna like 850 bucks.

When I heard that, I was like, fuck those people. Yeah,

Anna:I know. I was like, it’s the same amount of medication. It’s fewer needles. Why is that more expensive?

Dan: It’s only more expensive for you.

Anna: Yeah, exactly.

Dan: Yeah. All this leaves me definitely feeling like, screw those people. This is not our fault. It’s us against them and we gotta stick together.

Just doing this show is good for my mental health. I hope listening to it is good for yours. We are in this together and learning what we’re up against, even when it sucks and knowing that we’re in it together. I think there’s some power in that. Here’s one way you can help. Remember how Anna doubts she’s the only person to get hit with a bill for testing related to COVID-19.

I kind of doubt it too. Do me a favor. Help us out. Ask everybody you know, did this happen to you, especially with Aetna. Let us know at Arm and a leg show.com/contact. That is a great place to share any stories you think we should know about and to ask any questions you have. We’ll get the smartest people we know to tell us what they know.

That’s arm and a Leg show.com/contact. Or you can call and leave a message at 7 2 4 2 7 6 6 5 3 4. That is 7 2 4 Arm N Leg. This whole deal is made possible by listeners. This show had been running a couple of seasons a year, and now the pandemic means there’s just so many stories, so many questions. We are planning on being here every week for the duration.

We were able to bring the show back ahead of schedule and to start putting these weekly episodes out because more than 500 of you were already pitching in. If contributing to this show is not in your reality right now. I totally get it, but if you are in a position to join in and help out, we would so appreciate it.

You can sign up to support us on Patreon or make a tax deductible donation. You’ll find links to both of those options at Arm and a leg show.com/support if you can and if you game, thank you so much and no matter what, thanks for listening. I’ll catch you here next week. Till then. Take care of yourself.

This episode was produced by me, Dan Weissman, edited by Anne Erman. Daisy Rosario is our consulting managing producer, and Adam Raimundo is our audio wizard. Our music is by Dave Weiner and Blue dot session. Big thanks this week to Carmen Heredia Rodriguez. Carmen reported Anna’s story for our pals at Kaiser Health News.

Spent time talking with me, put me in touch with Anna, and generally allowed me to piggyback on all her hard work. We will put a link to Carmen’s version of the story wherever you find this episode. This season of an Arm and a Leg is a co-production with Kaiser Health News. That’s a nonprofit news service about healthcare in America.

That’s an editorially independent program of the Kaiser Family Foundation. Kaiser Health News is not affiliated with Kaiser Permanente, the big healthcare provider. They share an ancestor. This guy Henry j Kaiser, he had his hands in a lot of different stuff like concrete, aluminum ship building. When he died more than 50 years ago, he left half his money to the foundation that later created Kaiser Health News.

You can learn more about him and about Kaiser Health News at Arm and a Leg show.com/kaiser. Diane Weber is National Editor for Broadcast and Tanya English is Senior Editor for Broadcast Innovation at Kaiser Health News. Their editorial liaisons to this show finally. Thank you to some of our new backers on Patreon pledge.

Two bucks a month or more. You get a shout out right here. Thanks. This week to Matthew Valier, Ann McCadden, Rita Tahan, Christine Iasa, and Tim w. Thank you so much for making it possible for me and my colleagues to make this show and as a way to say thanks especially to anybody who loves the show, the Good Place.

Here’s a bit from my discussion with healthcare insurance expert Sabrina Corlett about the kind of time travel we’d need in order for her to have protected Anna. It’s like we’re Michael in the good place and we can make anything happen. Yes. Time is Jeremy. Jeremy.

Sabrina: I’m Janet. Yeah. Right. Yes, right, exactly.

Latest Episodes

‘Sh**’s wild’: Scaling up, doubling down, and buckling in

Our favorite project of 2025 levels up — and you can help

Some more things that didn’t suck in 2025

Looking for something specific?

More of our reporting

Starter Packs

Jumping off points: Our best episodes and our best answers to some big questions.

How to wipe out your medical bill with charity care

How do I shop for health insurance?

Help! I’m stuck with a gigantic medical bill.

The prescription drug playbook

Help! Insurance denied my claim.

See All Our Starter Packs

First Aid Kit

Our newsletter about surviving the health care system, financially.