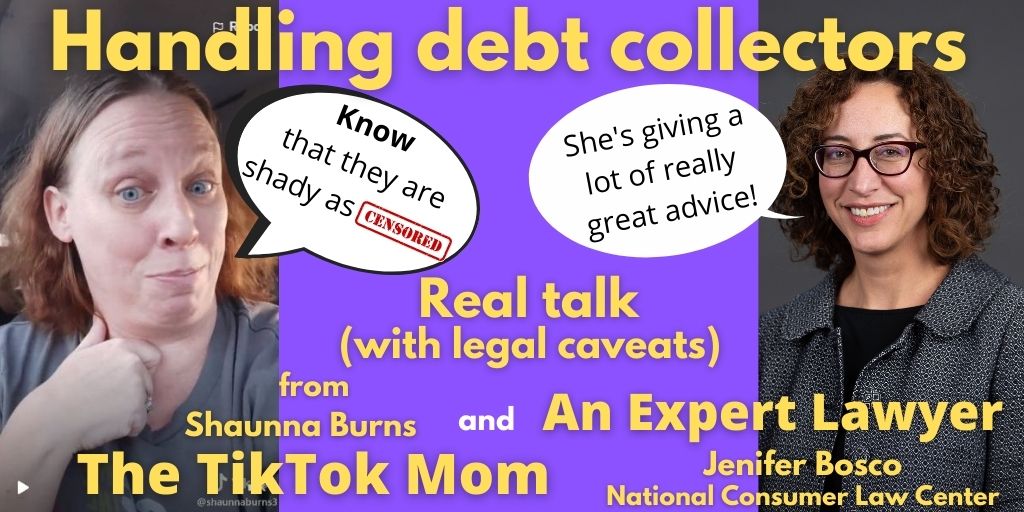

How to handle debt collectors, with the TikTok Mom and an expert lawyer

SEASON 4-ever – Episode 6

There’s a reason Shaunna Burns went viral with her videos about dealing with debt collectors: She used to be one, so she knows a few things. (Also she’s smart and funny.) We fact-checked her advice with a legal expert: Jenifer Bosco, an attorney with the National Consumer Law Center.

Who said: Yep, most of Shaunna’s advice totally checks out.

This one’s full of useful tips,and it’s fun, so please pass it around. Debt collectors are out in force, and as you’ll hear in this episode, they can be super-unscrupulous. But, as you’ll also learn: We’ve got rights. Scroll down for some resources….

You don’t need to have heard our earlier episode about Shaunna and her story; you can just start right here. (There’s lots of strong language in both this and the previous Shaunna episode, so maybe save them for when the kids aren’t around. Wanna read up right away? Here’s a transcript.)

Meanwhile, here’s a bunch of links to resources:

The National Consumer Law Center, where Jenifer Bosco works, publishes the book Surviving Debt

- There are chapters on medical debt, dealing with debt collectors, and what to do if you get sued

- The book is updated every year

- It’s free to read online at https://library.nclc.org/sd

Consumer-finance expert Gerri Detweiler, who helped fact-check one big question for this episode, has a VERY useful-looking site called Debt Collection Answers.

- She just published a new article with answers to questions like “Can medical bills be sent to collections if you’re making payments?” (yep) and “How do I dispute a medical bill in collections?

- There’s another, more-general primer on medical debt/collections, also updated recently.

- Gerri and co-author Mary Reed offer their e-book Debt Collection Answers as a free download. (It was published in 2015, so it may not be as up-to-date.)

Shaunna’s dealing-with-debt-collectors TikTok videos

Be sure to note Jen Bosco’s legal caveats, but these are great and will get you in a fighting spirit

- Rapid-fire advice: They can’t just call whenever they want. There’s a statute of limitations on debt. You can, and should , demand documentation.

- If they can’t document that this debt is valid… you’ve got options.

- You’re under no obligation to give them any information.

- If the debt is valid, BE NICE. Take their calls. You may eventually be able to work out an OK deal.

Send your stories and questions: https://armandalegshow.com/contact/ or call 724 ARM-N-LEG

Support us: https://armandalegshow.com/support/