Will we be able to afford insurance in 2026?

For the first time, our senior producer, Emily, has to sign up for Obamacare. And it turns out, it’s one heck of a year to do that.

A recent headline from KFF Health News reads: “Insurers and customers brace for double whammy to Obamacare premiums.”

We break down what those “whammies” might mean in dollars and cents for Emily and the millions of others signing up for Obamacare in 2026.

Plus, we cover what’s happening with ACA navigators – the people charged with helping you sign up for Obamacare, and what to expect in November when open enrollment kicks off.

Learn more about what’s coming in 2026 in our First Aid Kit newsletter.

Check out KFF’s Obamacare premium calculator.

Send your stories and questions. Or call 724 ARM-N-LEG.

Of course we’d love for you to support this show.

Dan: Hey there–

Over the summer, our pals at KFF Health News published a story with the headline: “Insurers and customers brace for double whammy to Obamacare premiums.”

Basically– whammy number one — insurers are planning to raise premiums for 2026 —

And whammy number two: federal subsidies for Obamacare policies are scheduled to get a lot less generous.

Together, these whammies mean millions of people will be looking at paying a LOT more every month — like hundreds of dollars more.

Folks are going to need as much advance warning as possible, to figure out how to prepare for a hit like that.

Meaning: This is our kind of story.

And this one hits a little close to home. Because one of those folks is An Arm and a Leg’s senior producer, Emily Pisacreta.

Emily: Yeah, it’s a wild time. I’ve never had to do this before. Cuz I’ve always had health insurance through work. I’ve totally shaped my life around that because I have diabetes, and without health insurance, I can’t afford what I need.

Dan: But that health insurance has never come from An Arm and a Leg. When Emily started working here as an intern, she was the first person besides me to work more than a few hours a week. We didn’t have an employee health plan because we didn’t have employees.

And we’re still so tiny, so tiny. Apart from summer interns, there’s still only ever been one other person working more than a few hours a week besides the two of us. I’m still the only full-time person, and we still don’t have an employee health plan.

Emily: And until recently, that worked for me– I had another part-time job, and it had health benefits.

Except my contract with that job just ended.

So for the first time, like more than 20 million other people, I’m looking at open enrollment. And I gotta say, it’s one hell of a year to do that.

Dan: You’re a double-whammy case study.

And to get a broader perspective, the two of us talked with Julie Appleby, the reporter who wrote that “double-whammy” story, and since then you’ve continued to do more homework.

Emily: It’s been pretty intense!

Dan: For real. And I’m a little bit of a case study too:

Suddenly I’m finding out what our country’s “system” — where health insurance gets tied to jobs — looks like … from the employer side. It’s a whole new adventure.

We don’t know exactly what we’re going to do. Honestly, I don’t think anybody does.

But we’ve learned a ton. About what we’re up against — along with millions of other people — and our options.

And by tackling this right now — six weeks before open enrollment starts — I hope we can help a lot of other people start planning early with solid information. Let’s go.

This is An Arm and a Leg, a show about why health care costs so freaking much, and what we can maybe do about it. I’m Dan Weissmann. I’m a reporter, and I like a challenge. So the job we’ve picked on this show is to take one of the most enraging, terrifying, depressing parts of American life, and bring you a show that’s entertaining, empowering, and useful.

So, we started by checking in with the person whose reporting first got us looking at this story.

Julie Appleby: It’s recording. It looks like it says 10, 11,

Dan in interview: perfect.

Julie Appleby: I have notes and I’ll try not to rattle the papers.

Emily in interview: I mean, if we have a reporter on tape rattling papers, I feel like that’s probably okay.

Julie Appleby: Okay. That’s a plan, man.

Emily in interview: Yeah. Why don’t we start out, could you just like, tell us your name and what you do and where you work?

Julie Appleby: So this is Julie Appleby. I’m senior correspondent at KF Health News.

Emily in interview: What sort of stuff do you cover?

Julie Appleby: I cover healthcare policy, but that’s a broad term. So everything from cost to, the Affordable Care Act, to what’s going on with Medicare, all kinds of different things involving health care programs and insurance.

Emily in interview: So we were really excited to talk with you, because we wanted to cover, you know, all the changes to the marketplace plans, that you’ve been writing about. And, it just so happens that I need to enroll in a marketplace plan.

Julie Appleby: So let’s give you kind of the rundown. There’s like, there’s kind of like two things going on here. One of them is that just premiums are going up as they do every year. Although this year it’s bigger than it’s been since 2018. So the median increase nationwide, and this is according to some data research by KFF, is about 18%. So that’s a big jump, right?

Emily in interview: Yeah. Yeah. In your reporting you called it a double whammy. Rates are going up, enhanced subsidies are probably going away.

Julie Appleby: Right. That’s the second half of the double whammy.

Dan: OK, breaking in here– gonna do this a couple of times for Obamacare vocabulary. Emily just mentioned an important term, went by kinda fast: enhanced subsidies. Obamacare has always included subsidies for most people — that’s part of the “Affordable” part of Affordable Care Act. But for lots of people, Obamacare policies still were… pretty expensive!

So, in 2021 — like, as part of a COVID recovery package — Congress added extra subsidies for Obamacare policies: Enhanced subsidies.

Julie Appleby: Basically, they made the coverage more generous on both ends of the income spectrum. In fact, I think I was looking at some statistics this morning and something like, 80% of people who have coverage right now have a plan that’s $10 a month or less.

Dan: These are folks with lower incomes — where paying sixty or eighty dollars a month is a big bite. With “enhanced” subsidies, that became ten dollars — or even zero.

But people with higher incomes also got help. Before the enhanced subsidies, people with incomes above a certain level didn’t get ANY subsidy. People called it an “income cliff.”

For the last four years these enhanced subsidies, kind of erased that cliff. If your income was higher, you just paid a percentage of your income. Enhanced subsidies picked up the rest.

But the enhanced subsidies weren’t permanent. They’ll expire at the end of this year, unless Congress extends them. Otherwise…

Julie Appleby: people who make more than the four times the federal poverty level will not qualify for any help with their premiums under the Affordable Care Act. There will be that cliff.

Emily in interview: Right, right.

Dan: And it turns out Emily is basically standing on that cliff. She shows Julie the numbers.

Emily: We found this calculator from KFF that attempts to show the changes in premiums if the subsidies expire. And maybe I’ll just share my screen and we can look at – we can look at what I’m looking at.

Okay, you guys see KFF? Maybe just reload and I can enter some Emily figures in here. So, they ask you about where you live and your yearly household income.

Dan in interview: what’s the amount that you’ve entered as income?

Emily in interview: I have entered $63,000. And it says, without enhanced subsidies, you will likely lose financial help. Because my income is 418% of the federal poverty level.

Dan: Oy. a little more Obamacare vocabulary. First: Federal poverty level. Four times that level is where you fall off the income cliff, no subsidies. 400 percent. And the calculator – which we should say, is a year out-of-date, so the numbers aren’t precise, but they give us an idea– that calculator says Emily’s at 418.

And next: ?Obamacare plans come in different “levels,” like Olympic medals: Bronze, Silver, Gold… Bronze plans are the cheapest, and cover the least.

If Emily got a subsidy, the calculator says a silver plan would be like 400-and some dollars a month, but it says Emily wouldn’t GET a subsidy, so…

Emily in interview: It would be about $880 a month for a silver plan, or $675 a month for a bronze plan. So for me, that is stressful to read.

Julie Appleby: That’s a lot of money. 880 bucks a month. So you’re in the situation where you don’t get any, subsidies because your income is over that amount. But I played around with one of these calculators too when I wrote a story recently. And I also plugged in somebody, let’s say who’s earnings are kind of at the lower end of the income scale, say just over 150% of the federal poverty level. So they’re still gonna pay more. They’re, it’s gonna go from paying sort of a national average of about $2 a month to 72 bucks a month, or $864 a year. And remember, this is somebody who’s making 23,000 a year. So $864 is a lot of money.

Dan in interview: Emily, can you put that calculator back up on the screen for us?

Emily in interview: Sure can.

Dan in interview: The scary calculator. I mean, what would happen if your income were just a little bit lower? If you just shave $3,000 from your income, what does it look

Emily in interview: So maybe like 60?

Julie Appleby: I bet you could even shave a little bit less. Why didn’t you make it 62?

(Sfx: Buzzer)

Dan: How about 61? What does 61 do for us?

Emily in interview: Can I get a 61

(SFX: Buzzer)

Dan: how about $60,500?

(SFX: Buzzer)

Dan in interview: I feel like this is like an auction reverse.

Emily in interview: I know this is like the auction from hell

Dan in interview: Yeah, we’re, we’re lowering your income. So let’s keep going. $60,200,

(SFX: Ding!)

Dan in interview: That is it. Holy crap it’s a giant cliff. It’s a $5,000 cliff

Dan: Breaking in one last time: Five thousand dollars is how much money Emily might save on Obamacare premiums if her income stays below that 400 percent line. Put another way: It’s how much more she’d have to pay if she steps over that cliff.

Dan in interview: Julie, what does that look like to you, seeing that?

Julie Appleby: I think this also, this illustrates a lot of things. I mean, people are gonna have to keep in mind that cliff for next year if these tax credits aren’t extended. This is a projection, this is what you think you’re going to earn next year. So that’s one thing that to keep in mind, okay? And something could happen. Emily could, I don’t know, maybe she wins the lottery or she goes to the casino and wins a bunch of money and that puts her over.

Emily in interview: Or offers me, you know, a freelance job that’s really interesting. It doesn’t pay that much, but just puts me over, you know?

Dan in interview: You have to say, I’m sorry, that freelance job is gonna cost me more than $5,000 to accept.

Dan: So, Emily: listening back to that conversation now. What are you feeling?

Emily: I mean, I was trying to stay calm but internally I was freaking out. As Gen Z likes to say, I was crashing out.

Dan: It was really emotional. We both needed time to cool off, just to put this story together.

Emily: Yeah, this situation is stressful. I don’t know for sure how much money I’m even going to make next year. And it feels kind of weird to put all this out here. I don’t know how any of this sounds to other people. Because maybe it sounds like 400% of the federal level is a lot of money. And in some parts of the country it definitely is. But I live in New York City. So my income doesn’t go that far. And that $880 bucks a month we were talking about? That’s actually a big hit.

Dan: Yeah and — not to pile on, but: the data behind the calculator where we got that number, 880 — that’s last year’s data. So it doesn’t include the big premium increases that Julie was writing about. The actual amount you’d be paying every month would be bigger. And you looked up the deductible: more than four thousand dollars.

Emily: Right, which I won’t have lying around at the beginning of next year either. Yeah so honestly, all of it still makes me want to scream.

Dan: Yeah, and you’re a case study for a LOT of people. Julie read us a really sobering number, where one consulting group estimated that with this double-whammy Obamacare enrollment could drop by like half or more.

And, in fact, one of the reasons insurers say they’re raising prices this year is– without the enhanced subsidies, they figure a lot of healthy people will just opt out.

Emily: ?I can see why people don’t sign up. I mean, I don’t have that choice. But in order to get a subsidy, I’d have to lower my income, and to a very specific number – which is less than I live on now. And watch it to make sure I don’t take in a penny more.

Dan: While still paying hundreds of dollars a month for Obamacare?– even with a subsidy.

Emily: And look. This is a thing a lot of people do. All the time. –intentionally limit their income to qualify for assistance.. To keep Medicaid, people skip out on jobs, careers, marriage.

?So my situation is NOT unique. It’s definitely not the worst.

Dan: You’re our in-house case study. You can’t stand in for everybody.

I mean, just to add one more wrinkle: If you didn’t live in a super-expensive city, your premiums would actually be lower..

I used that calculator to look up what you’d pay for a silver plan in … Chicago, like where I live? Way, way cheaper. Like, unsubsidized? A lot less than a New York plan *with* a subsidy. I’m just saying.

Emily: That’s… wild. No shade on Chicago But I don’t think I’m ready to make a long distance move for health insurance yet.

Dan: I’m just saying…

Emily: But while we’ve been looking ahead to 2026 insurance, I’ve actually had a more-immediate decision to make.

Dan: Right.

Emily: LIke I said before, I had insurance through my old employer. But that’s ending. While we were doing this story, I had to figure out health insurance for the last three months of 2025.

Dan: You ended up getting some help from a real expert.

Emily: I sure did.

Dan: And: I called up An Arm and a Leg’s insurance broker.

Because like we said: If Emily’s a case study, so am I. We’re so small, and I’m the only one here who’s needed health insurance from this tiny little enterprise. Now, things are a little different.

What we’ve learned, and what’s next. That’s just ahead.

This episode of An Arm and a Leg is produced in partnership with KFF Health News. That’s a nonprofit newsroom covering health issues in America. Their journalists — like Julie Appleby — do amazing work. We’re honored to be their colleagues.

Emily: Julie Appleby left me with a little advice: Connect with an ACA navigator.

Dan: Navigators: These are folks who can guide you through the process of signing up for Obamacare. They’re not brokers, they don’t make a commission. They’re paid by the government.

Emily: But they’re not government employees — local organizations work on government-funded contracts.

Dan: Which makes sense– Obamacare plans themselves are basically local: The menu of plans to pick from, they don’t just vary from state to state: They can be different from one county to another.

Emily: And I wanted a little perspective on how the whole navigator program works.

Dan: And it turns out: We know someone at the organization that coordinates all the navigators in New York state.

Elisabeth Benjamin: My name is Elizabeth Benjamin. I’m Vice President for Health Initiatives at the Community Service Society of New York.

Dan: We’ve spoken with Elisabeth before — a bunch of times — about her work pushing hospitals in NY to quit suing people over medical debt.

And yes, it turns out her shop also runs the network of navigators throughout New York.

Emily: But when we talked, it turned out, her connection to the navigator program is a little different than I’d expected.

Elisabeth Benjamin: I don’t, you know, run it day to day, but I, myself do help people individually enroll. Because it’s really important to understand what people are experiencing, what their concerns are. I have like a small group of people that I help every year, Lots of friends, children.

Emily in interview: Oh, that’s awesome. Okay. Yeah, I bet you’re like a great like auntie to have..

Elisabeth Benjamin: You know, people that turn 26 and the parents are like, I know, please, will you help me?

Emily: She was like: Look, everybody needs help.

Elisabeth Benjamin: The bottom line is, you know, it isn’t for the faint of heart. It is hard to work through these websites. I mean, they are as user friendly as possible, but there’s like little kind of little moguls that you have to kind of ski over and it’s easy to kind of miss a mogul and faceplant, and we don’t want that to happen.

Emily: And when I told her about how my story fits into this episode, she was immediately like.

Elisabeth Benjamin: Oh, well, I can help you.

Emily: Not with my whole 2026 dilemma: there’s just no information about 2026 plans out there yet. But for my immediate question — what do I do about the rest of 2025 – she was like, I’m pretty free tomorrow.

Elisabeth Benjamin: You can tape your enrollment.

Emily in interview: Oh my gosh, that would be amazing.

Dan: Seriously amazing. I mean, it sounded like good tape, which we always like.

But also — we talked that day, you and me: You were really weighing some big decisions.

Emily: I mean one was: Do I sign up for Obamacare for the rest of the year, or do I stay on my old employer’s plan?

Because a law called Cobra means they have to allow me to buy in — but I’d have to pay the whole monthly premium, which was SUPER high. More than a thousand dollars.

So Obamacare was looking good. Those extra subsidies are still in place through the end of the year.

Dan: There was a downside.

Emily: Yeah — starting a brand-new plan would mean starting with a brand new deductible– money I’d have to pay out of pocket before the new insurance kicked in for most things.

Dan: Those can be like thousands of dollars.

Emily: Yeah, but then there was an amazing surprise: In New York, where I live, a new state law means that all Obamacare plans include insulin with no copay. Even if you haven’t paid out and hit your deductible. That’s a deal I’ve *never* gotten from any insurance, ever.

AND this deal included other diabetes supplies — like my continuous glucose monitor. That stuff can be hugely expensive.

So my thinking was like: I’ll grab the cheapest Obamacare plan– and get all my diabetes supplies — and I’ll try not to go to the doctor for the rest of the year.

Elisabeth Benjamin: Okay, so ready?

Emily in interview: I’m ready.

Emily: The next morning, I showed up at Elisabeth Benjamin’s apartment.

Elisabeth Benjamin: All right. So Emily, here you are, you’re on my dashboard. Oh, wait, here I can make this easier for you. Let’s do the big screen. Okay.

Emily: Elisabeth started walking me through the application. ?Name, date of birth, address… pretty routine to start.

Elisabeth Benjamin: That’s your phone number…

Emily: And at this stage I’m wondering if I should’ve just done it all myself and left poor Elisabeth alone.

But after a while — once we started actually looking at plans, I was like: Oh wow. Elisabeth was able to like really zip through things. It was a whole vibe.

Elisabeth Benjamin: Hold on one second. That’s not, that’s not important I wanna see if this is in network…

Emily: And she spotted things I would have totally missed.

Elisabeth Benjamin: So this is kind of an interesting plan. ’cause you would be able to go to a doctor or a specialist before the deductible.

Dan: Wait, you could do a doctor visit before you spent that deductible? That’s a thing?

Emily: Yeah, in that one plan, I guess? But even Elisabeth had to really dig to figure that out.

Elisabeth Benjamin: Like see, it’s sort of a little frustrating because you wouldn’t, you couldn’t really tell that from this. This is why it’s helpful to have a navigator

Emily: I mean, super-helpful: With Elisabeth’s help, I got a plan

Elisabeth Benjamin: and you’re done.

Emily: where OK, I can’t actually SEE a doctor before the deductible. Not in person. But I CAN do telehealth. So if god forbid I get some kind of weird infection, I could get a prescription. Oh, and my actual doctor, like my endocrinologist, is covered. And the deductible is much, much lower than the other plans I’d been looking at. I mean, it’s still scary as hell, but HALF as scary-as-hell?

Dan: And the only catch is: You have to do this all over again in November or December. Except then — unless Congress extends the extra subsidies — you may be looking at much higher monthly payments.

Emily: Right. Actually, let’s come back to me in a minute. Because the good news in my case: At least I’ll be able to get Elisabeth’s help again. Like, she offered to, which was so nice. But also: even if she’s super-busy, I’ll be able to talk to another navigator. Because I live in New York.

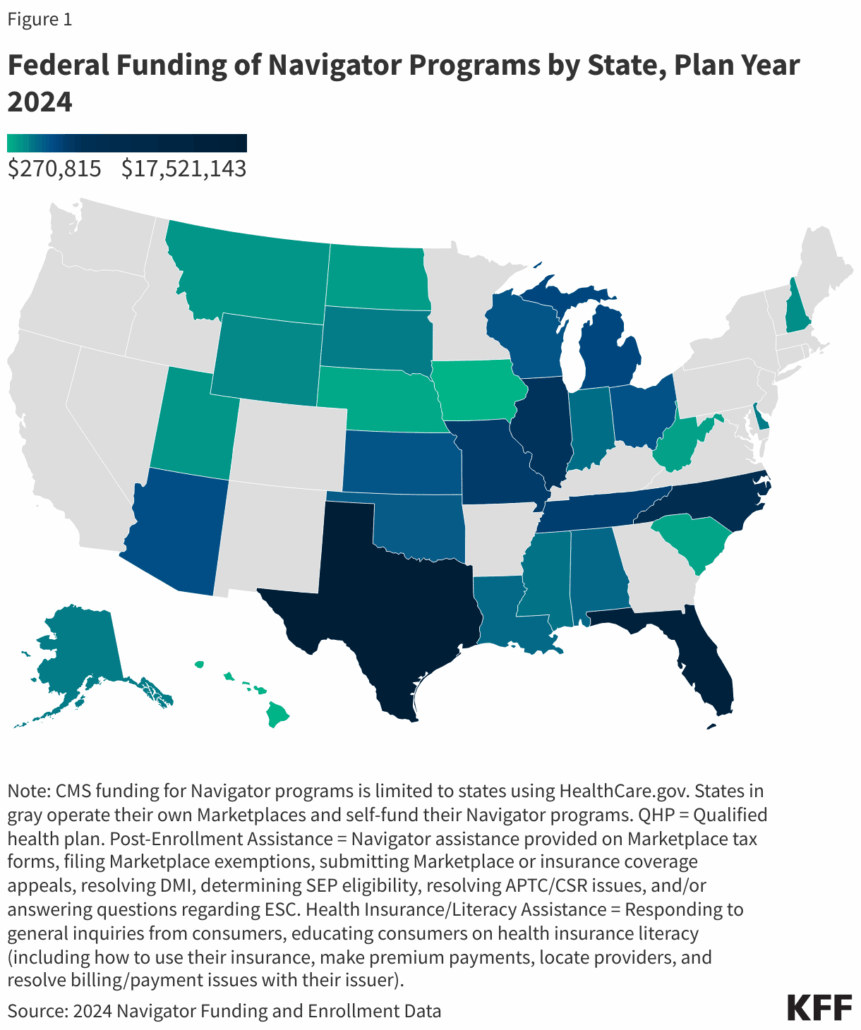

Dan: Yeah. This is one of the things we learned from Elisabeth. It goes back one of the reasons we wanted to talk with her in the first place. Because there’s another big change with Obamacare this year: the federal government is cutting funding for navigators by like 90 percent. We wanted to hear from Elisabeth — how is that gonna affect her group’s work.

Emily: And — this was a surprise: She said it won’t affect her work at all– because New York navigators are funded by the state government. Turns out the same thing is true for about half the states. But I talked with Elisabeth’s counterpart in a state where that is not the case.

Nicholas Riggs: We are not gonna be able to reach the number of people we did before. That’s just reality. You can’t do more with less. People will lose their coverage because of this.

Emily: That’s Nicholas Riggs. He runs the NC Navigator Consortium.

Nicholas Riggs: We cover all 100 counties. We’re the only navigator entity in North Carolina.

Emily: He says a big piece of their work is actually outreach– finding people who may not know they can get this kind of help.

Nicholas Riggs: You know, there’s no list of the uninsured.

Emily: And they don’t just help people pick Obamacare plans– they help people sign up for Medicaid. A 90 percent budget cut hits all of that. He says they’re looking for more volunteer navigators, but it won’t be the same as having experienced staff.

Nicholas Riggs: What you’re losing is institutional knowledge. Volunteer navigators are great. But sometimes it takes a few years to really get a handle on some more complex cases.

Dan: I mean, Emily — you experienced first hand how big a deal it was to hae, like, a real expert walk you through this process.

Emily: Elisabeth spent almost an hour with me!

Dan: A lot of people won’t have access to that kind of help. It’s one more crummy thing we’re trying to help people plan for. You found a map that shows which states fund their own navigators. We’ll post a link — so people can see what the deal is in their state.

And Emily, let’s come back to you for a minute: You’re lucky to have access to the world’s greatest navigator, but unless Congress extends the enhanced subsidies, that next conversation with her is gonna be a lot tougher.

Emily: I mean, unless I get another job with health insurance first.

Dan: So, about that: While you were having your first conversation with Elisabeth, I was talking with An Arm and a Leg’s health insurance broker, Kurt Kaufman.

Because I was like: What can I do to make it possible for Emily to stick around?

I asked Kurt, could we set things up for Emily to buy into An Arm and a Leg’s plan? Like, at all?

Our insurance is from Blue Cross Blue Shield of Illinois. Could it cover Emily in New York? He was like

Kurt K: Yeah, that’s fine.

Dan: Then she,

Kurt K: a hundred percent.

Dan: She could be insured on our Illinois based plan,

even though she’s in New York.. Is that right?

Kurt K: All day long.

Dan: All day long,

Kurt K: yep.,

Oh, yeah.

Dan: So I was like: Um, how much would it COST?

He said, based on your age — insurance gets more expensive as you get older — like, five, six hundred.

Emily: That’s a LOT less than what the scary calculator said I’d pay for a Silver plan with no subsidies. That was showing like nine hundred dollars.

Dan: Yeah. I mean: These are 2025 numbers, just like everything else we’ve been looking at. Everything in 2026 is gonna be higher. But it seems like An Arm and a Leg gets a better deal than you’d get with Obamacare. However, there’s a but. You’d need to be full-time.

Emily: Aha!

Dan: Yeah. I mean we’ve got you at 20 hours a week.

Emily: Yeah.

Dan: I was like Oh my god. I’d have to DOUBLE that? But Kurt was like: Actually, no. The way insurance looks at it, if you were working an average of 30 hours a week, then you could qualify.

Kurt K: She could be meeting that definition of quote unquote full-time employee.

Dan: ?Which, you know, isn’t in my budget for next year– and I’m still working to make sure some other parts of our scrappy little budget get funded— but it’s not DOUBLE. I’m starting to think about it– like, a stretch goal. I mean, I’d LOVE to have more of your time. I dunno.

Emily: I mean I like the idea a lot! But there are just a lot of unknowns, right?

Dan: Yeah, here’s where we’ve landed: You’ve got health insurance lined up for the rest of 2025. And after that, there’s so much we don’t know. Will I find more money? Will you take another job?

And: Will Congress extend the enhanced subsidies? When we first started working on this story, over the summer, experts were like, “That’s not gonna happen.”

But in the last few weeks, SOME Republicans have been proposing it. We definitely don’t know — and it’s nothing we can count on.

It’s all, honestly, a little scary.

Emily: Honestly, more than a little.

Dan: BUT: We know more than we did. We’ve started really confronting the scary numbers and the unknowns. You’ve taken a practice run at picking insurance.

Emily: That was actually kind of a big thing.

Dan: It was, right? And: I’ve started thinking about stretch goals.

We’re more prepared.

And — here was the point of doing this whole case study– I HOPE we’ve just helped a lot of other people get more prepared, to start planning.

We’ll keep you posted on how things go for us. Some updates will show up in our First Aid Kit newsletter.

If you’re not getting First Aid Kit, go check it out.

Emily: While we were reporting this story, we published a guide there: Get ready, emotionally and financially, for 2026 health insurance.

Dan: It has links to resources we talked about here, and we’ll have more in this week’s First Aid Kit.

What you wanna do is go tor at Arm and a Leg show dot com, slash, first aid kit.

You’ll find the whole archive there — including notes about honestly, some extremely exciting projects that Arm and a Leg listeners are doing — and how you can pitch in.

We’ll be back with another podcast episode in a few weeks. Till then, take care of yourself.

Emily: This episode of An Arm and a Leg was produced by me, Emily Pisacreta

Dan: and me, Dan Weissmann.

Emily: With help from Janmaris Perez and Lauren Gould.

Dan: And edited by Ellen Weiss.

Adam Raymonda is our audio wizard. Claire Davenport is our engagement producer.

Our music is by Dave Weiner and Blue Dot Sessions.

Bea Bosco is our consulting director of operations.

Big thanks to Lynne Johnson, who just wrapped up her run as our operations manager. Lynne, your work has done SO much to make our work more sustainable. I can’t thank you enough.

An Arm and a Leg is produced in partnership with KFF Health News. That’s a national newsroom producing in-depth journalism about health issues in America — and a core program at KFF: an independent source of health policy research, polling, and journalism.

Zach Dyer is senior audio producer at KFF Health News. He’s the editorial liaison to this show.

An Arm and a Leg is Distributed by KUOW — Seattle’s NPR station.

And thanks to the Institute for Nonprofit News for serving as our fiscal sponsor.

They allow us to accept tax-exempt donations. You can learn more about INN at INN.org.

Finally, thank you to everybody who supports this show financially. You can join in any time at Arm and a Leg show, dot com, slash: support.

Latest Episodes

This health economist wants your medical bills

We love this listener’s project — and your response

Will we be able to afford insurance in 2026?

Looking for something specific?

More of our reporting

Starter Packs

Jumping off points: Our best episodes and our best answers to some big questions.

How to wipe out your medical bill with charity care

How do I shop for health insurance?

Help! I’m stuck with a gigantic medical bill.

The prescription drug playbook

Help! Insurance denied my claim.

See All Our Starter Packs

First Aid Kit

Our newsletter about surviving the health care system, financially.